Are you navigating the challenging Melbourne property market, caught between wanting to secure your dream home and needing to sell your current one? This common dilemma can be a source of significant stress, but with the right financial solution, it doesn’t have to be. Capkon Melbourne offers expert bridging finance broker services, providing the essential link to ensure a seamless property transition. We understand the nuances of short-term property finance and are dedicated to helping clients secure tailored bridging loan solutions.

At Capkon, we strive to facilitate the most accessible bridging finance solution and use our detailed understanding of the industry to help match you with lenders who can provide favourable terms and maximum flexibility. When you choose to work with expert Melbourne mortgage brokers, you will have even more choices since you will be provided with a broader supply of solutions. We make the financial side of things easy and clear; understanding, support, and decision-making should happen between you and your next property.

What is a Bridging Loan?

To put it simply, a bridging loan is a type of short-term financial product that can be used to cover the difference between buying a new house and selling an old one. It is also commonly known as a bridging home loan or a bridge mortgage. Suppose you have secured your dream new home, but the property in which you live is yet to be sold. The bridging loan will provide you with the purchase funds you require to give you more time to settle up the new purchase, and is similar to a deposit (usually) and provides funds to enable you to repay your current mortgage (if any) until your old residence is sold.

This is especially useful in competitive markets such as Melbourne, where a property may get sold within a very short frame of time, and waiting to sell means one is not able to sell. Bridging loans and general bridging finance provide the flexibility of moving swiftly, and they create essential financial breathing space. They are a short-term type of property finance, which means that they do not need the double move, or being under pressure of the rushed sale.

If you’re planning to buy before you sell or invest in another property, bridging finance can offer short-term flexibility. For a deeper understanding of long-term strategies, explore our guide on investment property loans Australia tailored for both first-time and seasoned investors.

How Capkon Helps as Your Bridging Finance Broker

As an expert bridging finance broker, Capkon plays a crucial role in making your property transition smooth and stress-free. Here’s how we assist you:

- Expert Advice: We provide clear, unbiased advice, helping you understand the intricacies of bridging loans and whether they are the right solution for your specific circumstances.

- Access to Multiple Lenders: We have established relationships with a wide network of lenders offering various bridging loan deals. This allows us to compare options and find the most suitable and competitive rates for you, which might be challenging to find independently.

- Personalised Loan Solutions: Your financial situation is unique, and so should be your loan solution. We tailor our recommendations to your individual needs, ensuring the bridging loan aligns perfectly with your property goals and financial capacity.

- Fast Response Times: The Melbourne property market moves quickly. We understand the urgency often associated with bridging finance and work efficiently to get you fast responses and approvals.

- Deep Melbourne Market Knowledge: Our team possesses in-depth knowledge of the Melbourne property market. This local expertise allows us to provide insights and strategies that are highly relevant to your specific location and market conditions.

- Stress-Free Process: From initial consultation to settlement, we manage the entire process, handling paperwork and liaising with lenders on your behalf, significantly reducing your stress and administrative burden.

Working with the right mortgage broker ensures you’re not overpaying for expert help. Understand what you’re paying for with our detailed breakdown of mortgage broker cost in Australia.

Why Bridging Loans are Ideal for Melbourne Homebuyers

Bridging loans offer distinct advantages, especially for residents of Melbourne navigating its dynamic property landscape:

Buy Before You Sell

This is perhaps the most significant benefit. A bridging loan allows you to secure your next home without the pressure of having to sell your current property first. This means you won’t miss out on your dream home in a fast-moving market.

Faster Settlement Times

With bridging finance, you can often achieve quicker settlements on your new purchase, which can be a key advantage when bidding at auctions or securing a sought-after property.

High Property Demand

In a market with high demand like Melbourne, being able to buy quickly gives you a competitive edge. Short-term bridging loans provide that financial agility.

Perfect for Upgraders

If you’re looking to upgrade to a larger home, a bridging loan can facilitate this move without the need for temporary accommodation.

Auction Ready

For those participating in Melbourne’s vibrant auction scene, a bridge mortgage can make you “auction ready” by providing immediate access to funds, allowing you to bid confidently without being reliant on the sale of your existing home.

Positioning bridging finance as a smart tool, it empowers you to make strategic moves in the property market, whether you’re upgrading your home or securing a property at auction.

Common Scenarios Where Bridging Loans Help

Bridging home loan solutions are incredibly versatile and can assist in various real-life property situations, particularly in Melbourne:

Buying Before Selling Your Current Home

This is the most classic use case. You have acquired a new home, yet a new buyer has not yet been found for your existing property. A bridging loan is used to pay against the acquisition of the new property and finance the old property's mortgage profile till your sale is concluded.

Auction Property Purchases

The auction market in Melbourne is very stiff. The bridging loan gives you the strength to bid confidently without assurances that you can cover the purchase after getting the funds easily once the purchase has been done, even though your other house is not yet sold.

Downsizing or Upsizing

Whether you're moving to a smaller, more manageable home or a larger one to accommodate a growing family, a bridging loan streamlines the process, allowing you to move into your new home without the stress of being in two places at once or needing temporary rentals.

Some homeowners also use bridging finance while renovating before listing their home for sale. In such cases, pairing it with our renovation home loans Melbourne options can be a smart move.

First home buyers who are transitioning from renting to owning may also consider short-term financing. Our home loan brokers for first home buyers can guide you through bridging and traditional loan choices with confidence.

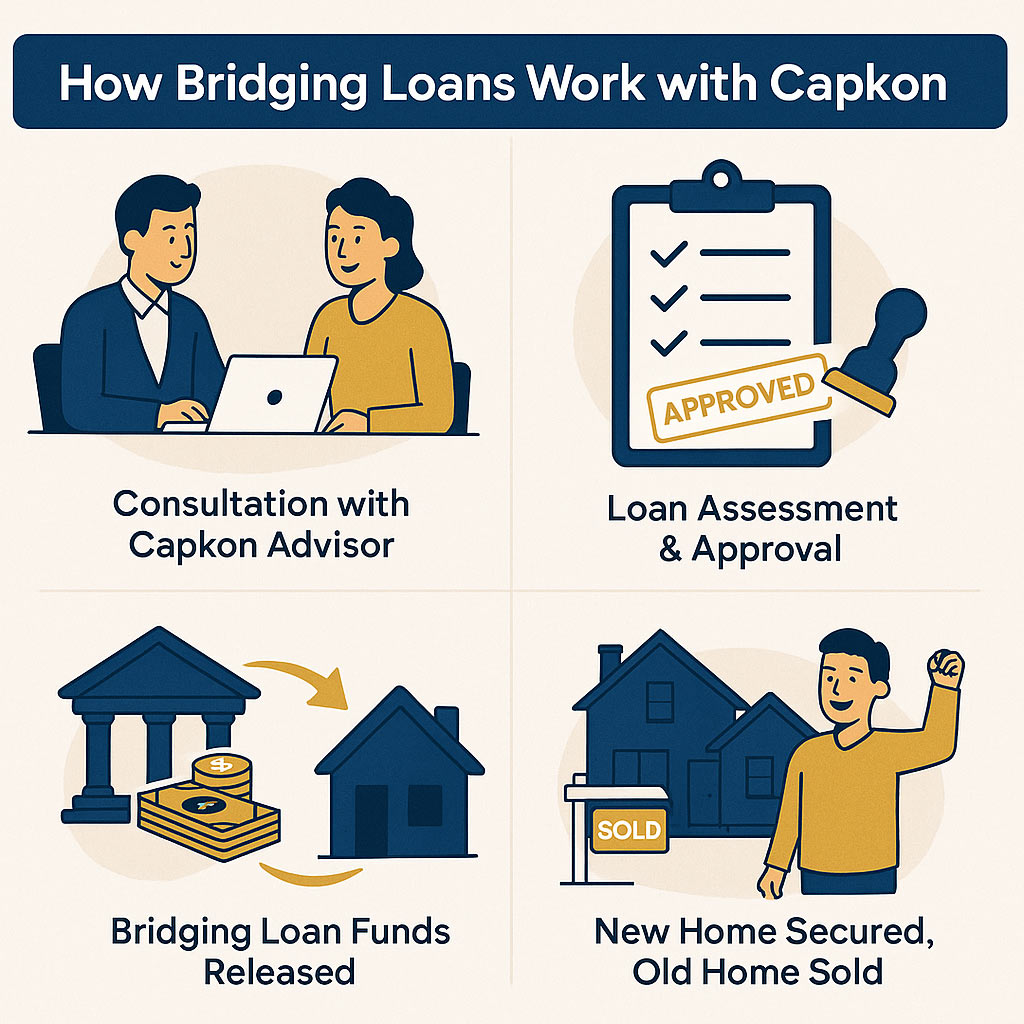

How Bridging Loans Work With Capkon

Understanding how bridging finance works is crucial. With Capkon, we guide you through a clear, step-by-step process:

Step 1: Consultation & Assessment

We start with an in-depth consultation to understand your financial situation, property goals, and the specifics of both your current and desired properties. This helps us assess your eligibility and determine the most suitable approach.

Step 2: Finding the Right Lender & Loan

Leveraging our network, we identify lenders offering bridging loan products that align with your needs. We compare bridge loan financing rates and terms to find the most advantageous solution.

Step 3: Loan Approval

Once a suitable lender is identified, we assist you in preparing and submitting your application. We work closely with the lender to ensure a smooth approval process, addressing any queries promptly.

Step 4: Settlement of New Property

Upon approval, the bridging loan funds are released, allowing you to settle on your new property. This is where the bridge mortgage truly “bridges the gap,” enabling you to move into your new home.

Step 5: Repayment After Sale

Once your existing property sells, the proceeds are used to repay the bridging loan. The remaining debt, if any, is then converted into a standard home loan, and your regular repayments begin. Capkon helps you navigate every step, ensuring you understand the process and your obligations.

Things to Consider Before Taking a Bridging Loan

While highly beneficial, it’s vital to approach a bridging loan with a clear understanding of the risks and responsibilities involved. Before applying, consider these key factors:

Understand the Costs

Bridging loans’ costs can include interest charges, application fees, and potentially higher interest rates than standard mortgages during the bridging period. It’s crucial to have a clear picture of all associated expenses.

Have a Clear Sale Timeline

While short-term bridging finance provides flexibility, it’s generally short-term (typically 6-12 months). Having a realistic plan for selling your existing property within this timeframe is essential. The longer it takes to sell, the more interest accrues.

Repayment Terms & Conditions

Familiarise yourself with the repayment structure during the bridging period (often interest-only, with interest potentially capitalised) and what happens once your existing property sells.

Be Prepared for Market Risks

The sale price of your existing property is an estimate. If it sells for less than anticipated, you may have a larger “end debt” on your new property.

Seek Professional Advice

Always get comprehensive bridging loan advice from a qualified broker like Capkon. We help you weigh the pros and cons based on your unique circumstances.

Who Can Apply for a Bridging Loan with Capkon?

Capkon supports a wide range of clients in determining their eligibility for a bridging loan. Basic eligibility factors generally include:

Your Home Equity

Sufficient equity in your current home is one of the key requirements for a property bridging loan. Lenders typically assess the difference between your property’s value and any outstanding mortgage. The more equity you have, the more you may be able to borrow. This is fundamental to securing a bridging loan.

Maximum End Debt

Lenders will assess the “maximum end debt,” which is the total loan amount you will have after your existing property is sold and the bridging loan is repaid. This final loan amount impacts lender decisions regarding your borrowing capacity and the overall viability of the loan. Your ability to comfortably service this bridge mortgage is crucial.

Serviceability

Lenders will rigorously assess your “serviceability” – your ability to repay both the bridging loan (during the bridging period) and the subsequent “end debt” loan. This involves evaluating your income, expenses, and existing financial commitments. This is often linked to the bridge loan financing rates and the overall bridging loans cost.

Sale Contract for Existing Property

While not always a strict requirement at the initial application, having a signed contract of sale in place for your existing property, or a robust and well-defined sales plan, can significantly improve your approval chances. It demonstrates a clear exit strategy for the bridging home loan. This is where a knowledgeable bridging loan broker can provide strategic guidance.

With or Without End Debt

Bridging loans can be structured in different ways. Some clients might aim for “no end debt” (e.g., if downsizing significantly), meaning the sale of their existing property covers the new purchase entirely. Others will have an “end debt” that converts into a standard mortgage. Capkon provides bridging loan advice on the best structure for your financial plan and your bridge mortgage needs.

What Documents Do You Need?

To streamline your bridging loan application, here’s a checklist of common documents you’ll typically need. Capkon provides comprehensive assistance with document preparation, ensuring you have everything in order:

- ID: Valid photographic identification (e.g., passport, driver's license).

- Mortgage Details: Statements for your existing home loan(s) on the property you intend to sell.

- Property Valuations: Recent valuation reports or appraisals for both your existing property and the new property you wish to purchase.

- Sale Contracts: If you have them, the signed contract of sale for your existing property and the contract of purchase for your new property.

- Income Verification: Recent payslips, employment contracts, tax returns (for self-employed individuals), and any other proof of income.

- Proof of Assets and Liabilities: Details of other assets (e.g., savings, investments) and liabilities (e.g., credit card debts, personal loans).

- Rental Statements (if applicable): If you have an investment property.

Having these documents ready will significantly expedite the process. Our bridging loan broker team, particularly experienced with home mortgage bridging loans and bridging loans in Melbourne, will guide you through gathering all the required information.

Why Capkon is Your Trusted Local Bridging Loan Expert in Melbourne

When it comes to securing a bridging loan in Melbourne, Capkon stands out as your trusted local expert. Our strengths are built on a foundation of commitment to our clients:

- Melbourne-Based Bridging Finance Experts: We are intimately familiar with the local property market, trends, and specific challenges faced by Melbourne homebuyers and sellers. This local insight means more relevant and effective solutions.

- Tailored, Honest Advice: We pride ourselves on providing transparent and personalised bridging loan advice. We don’t believe in one-size-fits-all solutions; instead, we focus on what genuinely works for you.

- Access to the Best Bridging Finance Deals: Our extensive network of lenders, cultivated over the years, ensures we can source the best bridging finance options available in the market, often uncovering deals you wouldn’t find directly.

- Trusted by Clients Across Melbourne: Our reputation is built on successful outcomes and strong client relationships. We are proud of the trust our Melbourne clients place in us.

- Transparent, End-to-End Support: From your initial inquiry to the final settlement of your properties, we offer complete support, keeping you informed and confident every step of the way. As your dedicated bridging finance broker, we handle the complexities so you don’t have to.

Let Capkon Melbourne Guide You to the Right Bridging Loan Solution

Don’t let the challenge of buying before selling hold you back from your next property dream. Capkon Melbourne is here to provide the expert bridging loan advice and solutions you need.

Ready to make your move? Apply for a bridging loan with Capkon Melbourne today and experience a stress-free property transition. Contact us now to book a consultation or to speak with one of our expert brokers about your bridging loan needs.

Frequently Asked Questions

Can I get a bridging loan with an existing mortgage?

Yes, absolutely. Bridging loans are specifically designed to help you purchase a new property while you still have an existing mortgage on your current home. The bridging loan will typically cover the outstanding balance of your old mortgage and the purchase price of your new property.

How quickly can I settle with a bridging loan in Melbourne?

While approval times can vary, Capkon works efficiently to expedite the process. Depending on the lender and the completeness of your documentation, it’s often possible to achieve settlement in a matter of weeks, sometimes even faster for straightforward cases.

What if my existing home takes longer to sell?

Most bridging loans have a typical term of 6-12 months. If your property takes longer to sell, you may need to discuss options with your lender, which could include extending the loan term (subject to approval and potentially higher rates) or refinancing. Capkon will provide bridging loan advice on contingency plans during your consultation.

Are bridging loans only for buying residential homes?

While commonly used for residential properties (owner-occupier and investment), bridging finance can also be used for certain commercial property scenarios or land purchases, depending on the lender and your circumstances. It’s best to discuss your specific needs with a Capkon broker.

Can I make interest-only repayments during the loan term?

Yes, it is common for bridging loans to have an interest-only repayment structure during the bridging period. In some cases, the interest may even be capitalised (added to the loan balance) until your existing property sells, reducing immediate cash flow pressure.

What happens after my existing property is sold?

Once your existing property is sold, the proceeds from the sale are used to repay the bridging loan. Any remaining balance (your “end debt”) will then typically convert to a standard home loan product (e.g., variable or fixed rate), and your regular principal and interest repayments will commence on that new loan.

Why should I use Capkon instead of going directly to a lender?

Using a bridging finance broker like Capkon offers several advantages: we have access to multiple lenders and their specific bridging loan deals, allowing us to find the most competitive rates and terms for your unique situation. We provide expert, unbiased bridging loan advice, handle the complex paperwork, and streamline the application process, saving you time, money, and stress, particularly in the fast-paced Melbourne market.