Dreams of homeownership in the City of Melbourne are usually accompanied by a major challenge, which is Lenders Mortgage Insurance (LMI). This extra money can cost tens of thousands of dollars on your house loan, making it more difficult to enter the market, particularly in the case of less than a 20% deposit.

At Capkon Melbourne, professional Melbourne mortgage brokers, we specialise in helping homebuyers navigate this challenge by securing no LMI home loans. We realise how important it is to get savings on initial expenditures, and our professional staff works tirelessly to identify ways of providing access to no lender’s mortgage insurance. And regardless of your current level of earnings (in case you are a professional, you are purchasing a first home, but all you have are just 10-15% deposits), we are in a position to assist you in finding a way to evade such expensive insurance.

Ready to unlock your path to homeownership without the burden of LMI? Contact Capkon Melbourne today for an obligation-free consultation.

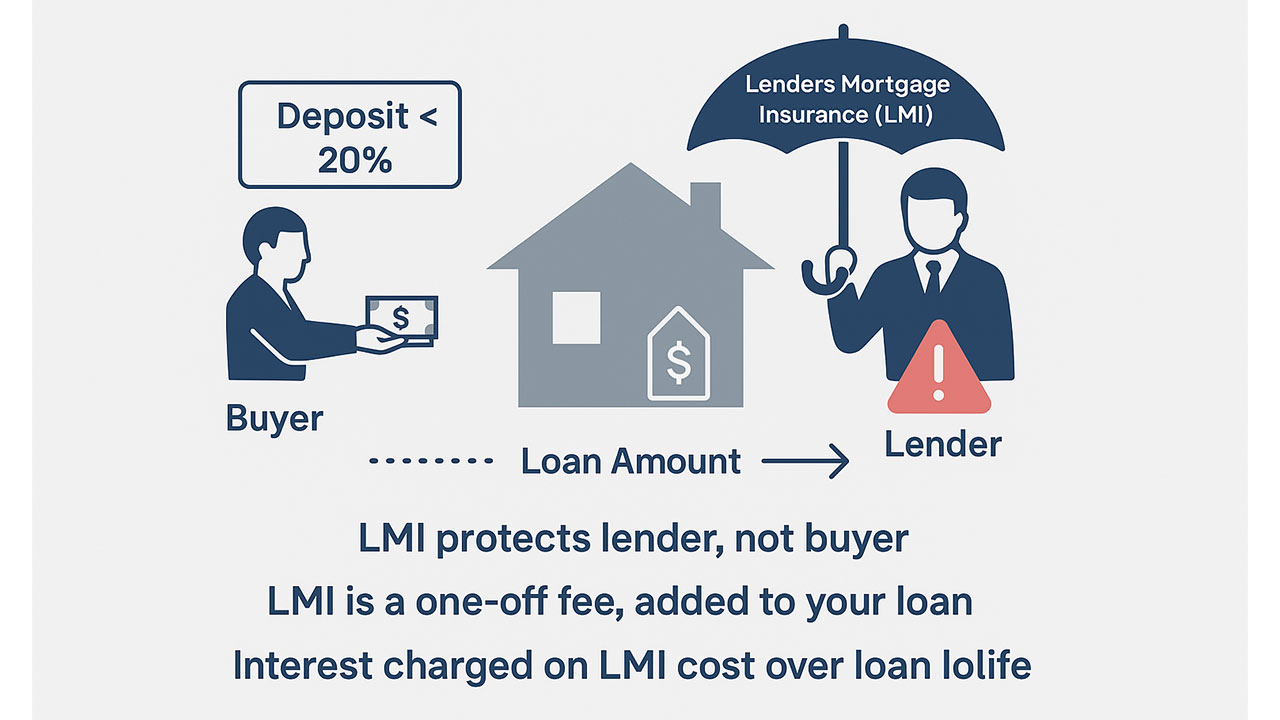

What is LMI, and why is it Usually Required?

Lenders Mortgage Insurance (LMI) refers to a one-off fee payable by most buyers on a home loan where the deposit to be paid by the buyer to the lender in purchasing a property is less than 20 per cent of the value of the property. It is imperative to comprehend that LMI insures the lender, not the borrower, against the possibility of financial loss if you default in paying your loan, and the subsequent sale of the property cannot procure enough money to pay off the loan.

Although it is a point of necessity to most people, it can become a huge additional cost burden and is usually added to your loan total, therefore being charged interest throughout the loan. This is the reason why a mortgage insurance waiver or LMI waiver is actively sought out by many buyers.

What Are No LMI Home Loans?

No LMI home loans are special home loan packages that enable their qualified borrowers to avoid Lenders Mortgage Insurance requirement, even when a high proportion of the purchase price of the house is being borrowed. That is, you will frequently be able to get a loan with an 85% no LMI or even 90% LVR no LMI without the excessive cost when the insurance premium is considered.

These loans differ from standard offerings because they come with specific conditions or eligibility criteria. Instead of paying LMI, which protects the lender, these schemes or professional waivers indicate that the lender perceives a lower risk, allowing them to lend with a smaller deposit without that added insurance layer. This is a game-changer for those seeking a home loan with no LMI or a 10% deposit home loan with no LMI.

Why LMI Is a Problem – and How Capkon Helps You Avoid It?

For many aspiring homeowners, Lenders Mortgage Insurance presents a significant hurdle. It’s a non-refundable, often substantial, cost that adds to your upfront expenses or increases your loan amount, impacting your overall affordability. It doesn’t protect you in any way; it solely serves the lender’s interests.

Capkon Melbourne helps you navigate this problem by:

Identifying specific lenders and schemes

We have an in-depth understanding of the market and know which lenders offer no LMI loans and how to access them.

Assessing your eligibility

We thoroughly review your profile to determine if you qualify for an LMI exemption or waiver based on your profession, income, or other criteria.

Optimising your application

We guide you through the process, ensuring your application highlights factors that increase your chances of securing a no-LMI home loan option.

How No LMI Loans Work – Understanding Your Options

No LMI loans essentially enable eligible buyers to purchase property with a smaller deposit than the traditional 20% without incurring LMI. These are not standard offerings and are provided by select lenders based on specific criteria. Understanding your options is key:

Guarantor (Parental) Loans

If you have a family member (usually a parent) with sufficient equity in their property, they can act as a guarantor for a portion of your loan. This reduces the lender's risk, allowing you to borrow up to 100% or even 105% of the property value without LMI. This is a powerful way to get a home loan no LMI.

Certain Professionals

Many lenders offer LMI waivers for professionals in fields deemed low-risk due to stable income and high earning potential. This means you could secure home loans with no LMI at 85% no LMI or even 90% LVR no LMI, even with a lower deposit.

Government Guarantee Schemes

Initiatives like the First Home Guarantee Scheme allow eligible first home buyers to purchase with a deposit as low as 5% without paying LMI, as the government acts as a guarantor for a portion of the loan.

Low LVR Loans Without Waiver

While not strictly "no LMI," some lenders may offer slightly reduced LMI premiums for borrowers with higher deposits (e.g., 15-19%) or in specific circumstances, although a full waiver is preferable.

Eligibility Criteria for No LMI Home Loans

Eligibility for no LMI home loans varies between lenders and schemes. Capkon Melbourne can assess your specific situation against these criteria:

Doctors

Doctors, including General Practitioners, Specialists, Dentists, Optometrists, and Veterinarians, are frequently eligible for substantial LMI waivers for professionals. They can often borrow up to 90% or even 95% of the property value without LMI, sometimes with no minimum income requirement from specific lenders. You typically need to be a member of a relevant industry organisation (e.g., AMA).

Accountants, Lawyers, Professional Athletes, and Entertainment Professionals

Many other highly-regarded professionals may also qualify for lenders mortgage insurance exemption or a full LMI waiver. This includes:

- Accountants: Often required to be Chartered Accountants (CA) or Certified Practicing Accountants (CPA).

- Lawyers: Including solicitors, barristers, and judges.

- Engineers: Certain engineering disciplines might qualify.

Professional Athletes & Entertainment - Professionals: Specific criteria apply, often related to stable income and high earning potential.

Eligibility often depends on your specific role, income, professional registration/membership, and the individual lender’s policy. Capkon checks eligibility across multiple lenders, since the approved list varies.

105% Loan with No LMI

This option is typically available through a guarantor loan. If you have a suitable guarantor (usually a parent or close family member) with sufficient equity in their property, they can use their equity as security for a portion of your loan. This allows you to borrow up to 100% of the property’s value, plus potentially cover additional costs like stamp duty, without paying LMI. This is not an LMI exemption but a structure that avoids it entirely.

90% Loan with No LMI

Achieving a 90% LVR no LMI is primarily for eligible professionals (as listed above) who meet specific income and professional registration criteria. Some lenders offer this as part of their professional LMI waiver programs.

85% Loan with No LMI and No Guarantor

This is a less common but highly sought-after option. Some lenders may offer 85% no LMI without a guarantor, often to certain professionals or strong applicants with excellent credit history and stable employment, even if they don’t fall into the highest-tier professional categories. This is where an 85 LVR no LMI becomes a real possibility for a wider range of buyers.

Full LMI Waivers for Recognised Professionals

As mentioned, some banks actively offer full LMI waivers for professionals, sometimes even up to 90% LVR. The list of eligible occupations can vary, but commonly includes:

- Doctors (GPs, Specialists, Surgeons)

- Dentists

- Engineers

- Lawyers (Solicitors, Barristers, Judges)

- Accountants (CA, CPA)

- Veterinarians

- Pharmacists

- Chiropractors

- Physiotherapists

- Nurses (in some cases)

- Pilots

- Certain highly paid executives

Capkon’s expertise lies in checking your specific eligibility across multiple lenders. We know that while one bank might offer a waiver for a particular role, another might not, or their criteria might differ slightly. We find the right fit for you.

LMI Exemptions for First Home Buyers

For first home buyers’ loan, specific government-backed schemes offer significant relief from LMI. The most prominent example is the First Home Guarantee Scheme (formerly the First Home Loan Deposit Scheme). This initiative allows eligible first home buyers to purchase a home with as little as a 5% deposit without paying LMI. How does it work? The Australian Government effectively guarantees a portion of your loan to the lender (up to 15%), removing the need for LMI.

This is a genuine LMI exemption for first home buyers lmi exemption, offering a direct path to saving thousands. Capkon can assist you in navigating the eligibility criteria for these programs, which typically include income caps and property price caps, and help you secure a spot if available. This is a fantastic opportunity for a first home LMI waiver or LMI waiver for first home buyers.

Low Deposit? You Could Still Avoid LMI

Even if you don’t fall into a specific professional category, having a decent low deposit (e.g., 10-15%) can still open doors to no LMI home loans. Some lenders offer specific products or policies that allow for 85% LVR no LMI or even 90% LVR no LMI based on a strong overall financial profile, excellent credit history, and stable employment, even outside of the explicit professional waivers.

Capkon excels at assessing these unique opportunities and applying for them on your behalf. We leverage our relationships with various lenders to explore every possible avenue for you to avoid LMI on your home loan.

Don’t Be Fooled by $1 LMI Offers

You might come across offers for $1 LMI from some lenders, often as a limited-time promotional incentive. It’s important to clarify that this is not a full LMI waiver or exemption. While it significantly reduces the cost of LMI to a nominal fee ($1), the LMI itself is still formally applied, and the offer typically comes with specific conditions (e.g., only for first home buyers, specific LVRs like 85%, or within certain loan amounts).

While a $1 LMI offer can still be beneficial, especially if you don’t qualify for a full waiver, Capkon helps you compare it with genuine LMI waiver scheme options and ensures you understand all the terms and conditions. We help you determine if it truly offers the best savings for your situation compared to other available mortgage insurance waiver pathways.

How Capkon Helps You Get a No LMI Home Loan & LMI Waivers

Capkon Melbourne acts as your dedicated advocate in securing a no-LMI home loan solution:

Find Lenders Who Offer No LMI

We have a comprehensive understanding of which lenders offer no LMI mortgage products and their specific criteria.

Check if You Qualify

We conduct a thorough assessment of your financial situation, employment, and professional status to determine your eligibility for various LMI waivers.

Explain the Risks

While we aim to save you money, we also ensure you fully understand any implications or specific terms associated with a no LMI loan.

Compare Your Options

We present you with a clear comparison of eligible loans, interest rates, and overall costs, ensuring you get the mortgage for less than truly suits your needs.

Help with Paperwork and Approval

We guide you through the entire application process, assisting with documentation, liaising with lenders, and advocating on your behalf to secure approval.

Ready to Buy with Less? Start Your No LMI Home Loan With Capkon Melbourne Today

Imagine saving thousands of dollars on your home loan, freeing up capital for renovations, furniture, or simply a healthier financial start. Avoiding LMI can make a significant difference to your borrowing power and overall homeownership journey.

Capkon Melbourne is your trusted partner in achieving this. We do all the heavy lifting – from comparing a vast array of lenders and their specific no LMI policies, to meticulously checking your eligibility, and expertly handling all the necessary paperwork. Our goal is to make your dream of owning a home in Melbourne a reality, without the burden of unnecessary costs.

Don’t let LMI stand between you and your new home. Take the first step towards a home loan with no LMI today. Book a quick call or send an enquiry to Capkon Melbourne now, and let us help you find your perfect no-LMI home loan solution.

Frequently Asked Questions

Can I combine a guarantor loan with an LMI waiver?

Typically, if you use a guarantor loan, LMI is not required at all because the guarantor’s equity provides sufficient security for the lender. Therefore, you wouldn’t be “combining” an LMI waiver in the traditional sense, as the loan structure itself eliminates the need for LMI from the outset.

Are there any fees or costs associated with applying for an LMI waiver?

While the LMI premium itself is waived, there are generally no specific fees from the lender for simply applying for an LMI waiver. However, standard home loan application fees, valuation fees, or legal costs may still apply, as they would with any home loan. Capkon’s broker services typically involve no direct fee to you, as we are paid by the lender upon settlement.

How long does it take to get approved for a no-LMI home loan?

The approval timeframe for a no-LMI home loan is similar to that of a standard home loan, generally ranging from a few days to a couple of weeks, depending on the lender’s processing times, the complexity of your application, and how quickly you can provide necessary documentation. Capkon works to expedite this process.

Does a no-LMI loan affect my interest rate?

In many cases, no LMI loans (especially those for professionals or through government schemes) can come with competitive interest rates, often comparable to those offered to borrowers with a 20% deposit. This is because the lender perceives you as a lower risk. However, it’s crucial to compare specific rates, and Capkon will ensure you get the best possible deal.

Can I refinance later and still keep my no-LMI benefits?

If you refinance with a new lender, you might be required to pay LMI again if your LVR is above 80%. An LMI waiver is specific to the original loan and lender. However, if your LVR has dropped significantly (e.g., below 80%) due to a property value increase or extra repayments, you might not need LMI on refinancing anyway. Capkon can advise on this.

What happens if my financial situation changes after getting an LMI waiver?

Your LMI waiver is based on your situation at the time of approval. If your financial situation changes (e.g., loss of job, reduced income), it primarily impacts your ability to service the loan, not the LMI waiver itself. It’s crucial to contact your lender and/or Capkon immediately if you experience financial hardship.

Are no LMI loans available for investment properties?

LMI waivers for professionals are sometimes available for investment properties, but the criteria can be stricter than for owner-occupied homes. Government schemes like the First Home Guarantee Scheme are generally for owner-occupier properties only. It’s best to discuss your specific investment goals with Capkon.

Do all lenders offer LMI waivers, or is it limited to select banks?

No, not all lenders offer LMI waivers, and the specific criteria and eligible professions vary significantly among those that do. It is a specialised offering. This is precisely why working with a broker like Capkon is essential, as we have access to a wide panel of lenders and know which ones offer these beneficial schemes.

How does Capkon Melbourne assist if my loan application is declined due to LMI issues?

If a loan application is declined due to LMI issues (e.g., not qualifying for a waiver or the LMI premium being too high), Capkon will assess the reasons for the decline. We then work with you to explore alternative solutions, such as approaching a different lender with more flexible LMI policies, exploring government schemes, discussing guarantor options, or advising on strategies to build a larger deposit. Our goal is to find a pathway to homeownership for you.