Call Prakash Acharya

Call Amrit Lamsal

Purchasing your first home is a major financial decision that you will ever take in your life, and the current property market in 2025 presents challenges of its own. Increasing property rates, fluctuating interest rates, and tightening lending policies have resulted in the fact that, more than ever, it is important to know what you are getting into.

The right advice can make the difference whether you are saving to deposit, assessing what offers the best home loan for first-time buyers, or how to stretch your money. Ready to enter the property market to buy your first home? Here are 10 practical tips that first-time home buyers in Melbourne should consider to be confident in their step-into-the-market efforts.

Tip 1 – Get Your Finances in Order Before You Start

The foundation of a successful home purchase is a rock-solid financial profile. Lenders in 2025 are scrutinising applications more closely than ever.

- The importance of checking your credit score. This credit score is one of the significant concerns when securing a loan and the interest rate at which you will be provided. Ask to get a free credit report early enough before it is too late to correct the mistakes. The greater your score, the greater the loan alternatives.

- Reducing debts and building a savings history. Minimise high-interest debts (such as credit card debts and the use of personal loans) because this enhances your borrowing capacity. Lenders would rather view steady and authentic savings over three or six months.

- Why lenders look at financial stability. Your stability proves you can manage a mortgage. Ensure your spending habits are in check and avoid taking on new, large debt while preparing to apply for a loan.

Tip 2 – Understand How Much You Can Borrow

Don’t confuse what a property might sell for with your true budget. Knowing your maximum capacity is crucial.

- Mortgage pre-approval explained. Pre-approval (or conditional approval) is a lender’s formal confirmation of the amount they are willing to lend you, based on an initial assessment of your finances.

- How borrowing power is calculated in 2025. A serviceability calculator is used by lenders and evaluate your income and expenditure, taking into account any outstanding debts and a buffer against interest rate increases. Talk to a mortgage expert to have a realistic and current estimate.

- Why knowing your budget upfront avoids disappointment. Browsing in your pre-approved budget is also time-saving, less emotionally damaging (because the home you love might not be within your budget), and allows you to move quickly when you do find the right place.

Tip 3 – Save for More Than Just a Deposit for First-Time Home Buyers

Most first-time home buyer tips revolve around the deposit, but the transactional costs can be very high and must also be considered.

- Typical deposit requirements for first-time home buyers. Although 20% is the ideal deposit to avoid Lenders Mortgage Insurance (LMI) and get a better interest rate, most schemes can now be deposited with 5% (see Tip 4).

- Hidden costs- Stamp duty, legal fees, and inspections: .Initial expenses comprise stamp duty (which can be an enormous burden, but first-time buyers are frequently exempt from/concessions on the duty are common), legal/conveyancing charges, building and pest inspection reports, loan application charges and mortgage registration fees.

- Planning to avoid financial stress. Budgeting for these additional costs (often 3-5% of the property price on top of the deposit) ensures you’re not caught short on settlement day.

Tip 4 – Research Government Grants and Schemes for First-Time Home Buyers

The 2025 landscape includes a variety of federal and state support measures designed to ease the entry barrier for first-time home buyers.

- Overview of current first-home buyer grants and incentives (2025). Key schemes include the First Home Guarantee (FHBG), enabling first home buyers to buy their home with a 5% deposit and no LMI, and state-based First Home Owner Grants (FHOG ) and Stamp Duty concessions/ exemptions.

- How schemes can reduce your upfront costs. LMI is often one of the biggest costs after the deposit and stamp duty. Schemes that waive LMI or provide grants can save you tens of thousands of dollars.

- Why it’s important to apply early. Schemes like the FHBG have limited allocations, which are distributed by participating lenders. Get pre-approval and secure your spot early.

Tip 5 – Compare the Best Home Loan Options for First-Time Buyers

Finding the right loan is as important as finding the right house. Your choice determines how much you pay over the next few decades.

- Fixed vs. variable interest rates.

- Fixed rates offer payment stability, which is excellent for budgeting but typically lacks flexibility (e.g., limits on extra repayments).

- Variable rates allow you to benefit from rate drops and offer flexibility like an offset account and unlimited extra payments, but your repayments can increase if rates rise.

- Special first-home buyer loan packages. Many lenders offer tailored packages that may include discounted interest rates or waived fees for first-time buyers.

- Why using a mortgage broker may save time and money. Using a broker, you could get a better deal than you would have on your own, as he could compare hundreds of loans with different lenders to help you obtain the most appropriate home loan according to your particular financial situation.

Tip 6 – Don’t Skip the Pre-Approval Step

Pre-approval is an often-underestimated tool in a competitive market.

- Benefits of pre-approval in a competitive market. Pre-approval is an indication to the agents and sellers that you are a serious buyer and you are willing to make a transaction. This assurance would provide you with a crucial advantage, particularly when it comes to the other buyers whose financing documents have not been finalised.

- How does it strengthen your position when making an offer? In a private sale, a quick, clean offer from a pre-approved buyer is highly attractive. At auction, it sets your maximum budget and ensures you can sign the contract immediately.

- Validity period and renewal. Pre-approvals usually last for 90 days. Keep track of the expiry date and be ready to renew it with your lender or broker if your house hunt takes longer.

Tip 7 – Be Realistic with Your Property Search

The first home rarely ticks every box, so clarity on your must-haves versus your wants is essential.

- Avoid stretching your budget too far. While interest rates may fluctuate, commit to a repayment amount you can comfortably afford, even with a buffer for rate rises. Overstretching leads to “mortgage stress.”

- Factors to consider: Location, transport, and growth potential. Look beyond the paint colour. Prioritise non-negotiables like commute time, school zones, access to essential services, and the area’s long-term growth prospects.

- Why compromise may be necessary for your first home. You might need to compromise on property size, age, or proximity to the city. See your first property as a stepping stone toward your dream home.

Tip 8 – Get Professional Help When Needed

The buying process involves complex legal and financial documents. Relying on experts reduces risk.

- The role of buyer’s agents, mortgage brokers, and conveyancers.

- Mortgage brokers assist with loan selection and application.

- Conveyancers/Solicitors handle all the legal transfer of title and contract review.

- Buyer’s agents (optional) search for and negotiate the purchase on your behalf.

- How expert advice prevents costly mistakes. Legal experts ensure contracts are sound, and financial experts protect you from choosing a predatory or unsuitable loan.

- Why DIY can sometimes cost more: Attempting to navigate legal or financial complexities yourself can lead to expensive errors, delays, or choosing a sub-par property or loan.

Tip 9 – Inspect Carefully Before You Commit

Never take a property at face value. Diligence before commitment is one of the most important first-time home buyer tips.

- Importance of building and pest inspections. These reports are your insurance cover against serious structural imbalances, serious maintenance problems or pest problems (such as termites) that can only be detected by taking a quick walk around.

- Identifying hidden problems that could become expensive. Issues like foundation cracks, faulty wiring, or a leaking roof can cost tens of thousands to fix and are often excluded from a home’s price unless identified early.

- Negotiating repairs or price reductions. If the report reveals significant faults, you gain leverage to negotiate the price down or request that the seller fix the issues before settlement.

Tip 10 – Check your Credit

A quick point to reiterate: check your credit report early to ensure you are in the best position for a lender to view your application favourably.

Bonus Point: Compare mortgage lenders

Do not simply go with your existing bank. Different lenders will have different criteria and different special offers for first-time home buyers- the most common is a discounted interest rate or waived fees. A quick comparison can save you significant money over the life.

Final Thoughts for First-Time Home Buyers in 2025

Coming into the property market in 2025 is a big task, but with the right plan and the right team, it is not only possible but can also be done. Concentrate on strong preparation, expectations, and securing the most appropriate financing with the best mortgage broker in Melbourne.

Contact CapKon today and speak to our mortgage advisor to find the best home loan for first-time buyers in today’s market.

FAQ related to First-Time Home Buyers

What are the best tips for first-time home buyers in 2025?

The most useful tips for first-time home buyers of 2025 are to start with pre-approval, minimise your personal debt to maximise your ability to borrow, and to use government programs such as the First Home Guarantee to cut your deposit and avoid LMI.

How much deposit does a first-time buyer need in 2025?

Ideally, a 20% deposit avoids Lenders Mortgage Insurance (LMI) and gets you a better rate. However, government schemes like the First Home Guarantee allow eligible first-time home buyers to purchase with as little as a 5% deposit, with the government guaranteeing the difference (saving you the cost of LMI).

What is the best home loan for first-time buyers?

The best home loan for first-time buyers is highly individual. It depends on your risk tolerance, income stability, and whether you value budget certainty (fixed rate) or flexibility and features like an offset account (variable rate). Consulting a mortgage broker is the best way to compare options across many lenders and find the most suitable product and rate.

Should I choose a fixed or variable loan as a first-time buyer?

A fixed-rate loan offers predictable, stable repayments, which is excellent for budgeting but sacrifices flexibility. A variable rate loan may be lower initially and allows features like offset accounts and extra repayments, but your repayments can increase if the official cash rate rises. A split loan (part fixed, part variable) offers a balance of both.

Can first-time home buyers get government grants in 2025?

Yes. In addition to state-based First Home Owner Grants (FHOG) for new builds and stamp duty concessions, federal schemes like the First Home Guarantee (FHBG) and the Regional First Home Buyer Guarantee are available in 2025, which can significantly reduce the required deposit and eliminate the need for LMI.

How do I improve my chances of loan approval?

Improve your chances of loan approval by: having a stable employment history, minimising high-interest debts, providing evidence of genuine savings, and checking your credit file to correct any errors before submitting your application.

What mistakes should first-time buyers avoid?

The most common mistakes are: skipping the pre-approval process, stretching the budget past a comfortable repayment level, neglecting to budget for all upfront costs (like stamp duty and legal fees), and failing to get building and pest inspections.

Taking out a home loan in Australia is a big step in your life, and your lender will consider various things as to whether you will make a good borrower or not. The income you have, the size of your deposit and your employment history are highly important, but the most important and least understood factor is something like your credit score; your credit score is your home loan. It is one of the major signs that lenders will look at to determine how reliable you are as a borrower.

The first step to a competitive interest rate and seamless application process is understanding the credit score required to get a home loan in Melbourne.

Why Does Your Credit Score Matter for a Mortgage?

Think of your credit score as a financial snapshot of your past borrowing behaviour. For banks and lenders, it serves as a powerful risk assessment tool.

- Higher score = Better terms: A high credit score for a mortgage loan signals to lenders that you are a low-risk borrower, which can give you access to lower interest rates and a higher borrowing capacity.

- Lower score = Stricter conditions: A low score may result in a higher interest rate, a smaller loan amount, or even a rejection of your application. Lenders might also require a larger deposit or a guarantor to offset the perceived risk.

Your credit score reflects your creditworthiness for a home loan.

Minimum Credit Score for a Home Loan in Australia

Not every lender has just one universally needed number. Equifax, Experian, and Ilion are the three major credit reporting mechanisms in Australia, and each of them is based on a different scoring model.

Here’s a general breakdown of their score ranges:

- Equifax (0–1200):

- 300–509: Poor

- 510–621: Average/Fair

- 622–725: Good

- 726–832: Very Good

- 833–1200: Excellent

- Experian (0–1000):

- 0–549: Below Average

- 550–624: Fair

- 625–699: Good

- 700–799: Very Good

- 800–1000: Excellent

- Illion (0–1000):

- 1–299: Low

- 300–499: Room for Improvement

- 500–699: Good

- 700–799: Great

- 800–1000: Excellent

Generally speaking, most lenders are pleased with a score in the Good range or higher (the most common range being 600 or higher, but not all models). A score of 700 or higher (Very Good or Excellent) is usually necessary to obtain the most competitive interest rates and terms on a loan. Understanding your minimum credit score on a house loan is the most important thing that one should know to buy a house based on credit score.

What Credit Score Do You Need for Different Types of Loans?

The credit score expectations can vary significantly depending on the type of home loan you are applying for.

Standard Home Loans

A score of 650-700+ is generally required by most of the big banks and lenders. This indicates to them that you have a good record of spending your money wisely.

Low Deposit Loans (LVR above 80%)

Lenders will consider you a riskier borrower when you have a smaller deposit than 20% and require borrowing more. In case of these loans, a credit score of 700 or above is likely to be required to cover the risk of a home loan.

First Home Buyer Loans

Some lenders might be more accommodating with first home buyers, particularly when you have a guarantor or when you are trying to obtain a government-supported program. Nevertheless, an excellent credit score will provide you with a better standing.

Specialist Loans (Bad Credit, Self-Employed)

Non-bank and specialist lenders cater to a wider range of financial situations. They can authorise the 500-600 score range, but it usually results in a trade-off of a higher interest rate and fee.

How Lenders Assess Your Credit Beyond the Score

Your credit score is just one piece of the puzzle. Lenders also perform a comprehensive review of your financial history. They look at:

- Repayment history: Do you consistently pay bills, credit cards, and loans on time?

- Defaults or missed payments: Have you had any significant defaults, bankruptcies, or court judgments?

- Credit enquiries: Have you made multiple applications for credit (loans, credit cards, phone plans) in a short period? This can be a red flag.

- Existing debt-to-income ratio: How much of your income is already committed to existing debt repayments?

- Employment stability: Your length of employment and income type also play a role in their assessment.

5 Ways to Improve Your Credit Score Before Applying

If your credit score isn’t where you want it to be, don’t despair. You can take proactive steps to improve it.

1. Pay Bills and Loans on Time

This is the most important factor. Automate direct debits or reminders to avoid missing any payment on credit cards or phone bills, and other loans.

2. Reduce Credit Card Balances

Maintain the amount of credit you use by balancing your credit cards. Lenders would like to see that you are only utilising less than 30% of your total credit limit.

3. Limit Credit Applications

Each time you apply for credit, a “hard enquiry” is recorded on your report. Too many enquiries in a short timeframe can make you look desperate for credit and negatively impact your score.

4. Check and Correct Credit Report Errors

Request a free credit report at Equifax, Experian, or Illion. Check it over to detect falsehood or fraud. If you find an error, you can contest it with the credit reporting agency.

5. Avoid Payday Loans or High-Risk Credit

Short-term high-interest loans are looked down on by lenders. When you have one on your report, it will be a big red flag.

Can You Get a Home Loan with a Low Credit Score?

Yes, it is possible. Having a low score may complicate the process, but it does not necessarily mean that you should give up on your dream of owning a home.

- Specialist lenders: Non-traditional lenders often have more flexible criteria and can assist clients with less-than-perfect credit.

- Guarantor loans: A family member with good financial standing can act as a guarantor, which reduces the risk for the lender.

- Larger deposits: A larger deposit shows the lender you are a serious and financially disciplined borrower.

- Higher interest rates: The trade-off for a lower score is often a higher interest rate, which is a key part of the credit requirements for home loan approval.

How a Mortgage Broker Can Help with Your Credit Score

This is where a trusted broker in Melbourne becomes invaluable. We don’t just process applications; we provide a personalised strategy.

- Understanding lender credit policies: We know which lenders are more flexible on credit scores for home loan requirements.

- Matching clients: We can match your financial profile with the right bank or non-bank lender that is most likely to approve your application.

- Strategies to improve approval chances: We can provide tailored advice on how to improve your score and financial position before you apply.

- Negotiating better rates: For those with a high score, we can leverage your strong financial position to negotiate better rates and terms.

Final Thoughts

Having a home loan credit score that is 600+ is generally regarded as a good score to have in Australia, though a score of 700 or more will open access to the best of the best loan products. Increasing your score will be time-consuming and require some discipline; however, the reward is great, which means improved rates and higher approval rates.

You can not make it on your own in the complicated world of credit requirements. A mortgage broker who has expertise can assist you on the road map to a successful home loan application and help you understand your credit status.

Contact us today and book a consultation with our expert mortgage brokers. Your credit score is our priority to get a better home loan.

FAQ – Credit Scores and Home Loans in Australia

What is the minimum credit score for a home loan in Australia?

While there’s no single minimum, most major lenders prefer a score of 600 or higher. For the best rates, aiming for a score above 700 is recommended.

Can I get a home loan with a bad credit score?

Yes, it is possible. Specialist lenders and non-bank lenders may consider your application, but they often require a larger deposit or charge a higher interest rate to offset the risk.

Does applying for a mortgage hurt my credit score?

Yes. When you apply, the lender performs a “hard enquiry,” which is recorded on your credit file and can cause a small dip in your score. Multiple enquiries in a short period can have a more significant negative impact.

How long does it take to improve a low credit score?

Improving your score takes time, as credit history is a long-term record. It can take anywhere from a few months to a couple of years to see a significant improvement, especially after addressing past issues like missed payments or defaults.

Do guarantor loans require a high credit score?

A guarantor loan can sometimes compensate for a low credit score, as the lender has the added security of the guarantor. However, a stronger score will still improve your overall application.

Do all banks use the same credit scoring system?

No. While they all use the reports from the same three credit reporting bodies, each bank has its own internal scoring and lending policies. A score that is “Good” for one bank may be considered “Average” for another.

What’s the difference between Equifax, Experian, and Illion scores?

These are the three main credit reporting bodies in Australia. Each has a different scoring range and slightly different criteria, so your score may vary between them. It’s a good idea to check your reports from all three.

Congratulations on buying your first home! It’s a huge achievement, but the journey doesn’t end there. Many first home buyers don’t realise that the home loan they initially secured doesn’t have to be their forever loan. In fact, after settling into your new property, you might be able to refinance your home loan to get a better deal, access equity, or manage your debts more smartly.

At Capkon Melbourne, we’re dedicated to helping first home buyers navigate the post-purchase landscape. This comprehensive guide will walk you through everything you need to know about mortgage refinancing in Australia, offering practical solutions from understanding how refinancing works to exploring advanced strategies like debt recycling. We’ll show you how refinancing your mortgage can significantly impact your financial future.

What Is First Home Buyer Refinancing and How Does it Work?

Refinancing, in simple terms, means replacing your existing home loan with a new one, often from a different lender. This new loan pays out your old loan, and you then make repayments to the new lender under new terms.

For first home buyers, refinancing holds particular significance. Often, your initial loan might have been a high-LVR (Loan-to-Value Ratio) product, part of a special government scheme, or an introductory offer designed to get you into the market. Once you’ve made a few repayments and your property value potentially increases (building equity), you’re in a stronger position to refinance to a more competitive, standard home loan.

Essentially, how does refinancing a home loan involves a new lender assessing your current financial situation, your property’s value, and your repayment history. If approved, the new lender “takes over” your mortgage, potentially offering a lower interest rate, different features, or even access to some of your accumulated equity. This process effectively answers the question of what refinancing a house is – it’s optimising your mortgage after you’ve established yourself as a homeowner.

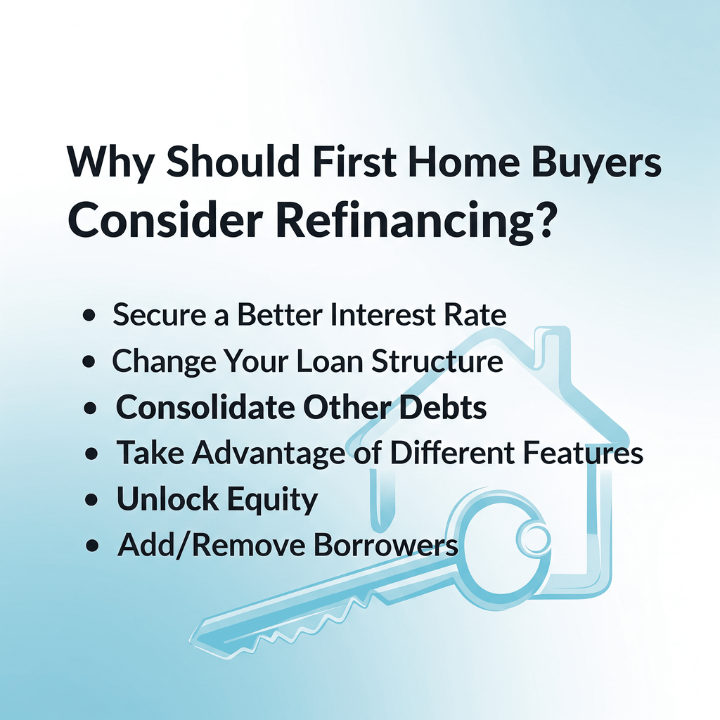

Why Should First Home Buyers Consider Refinancing?

As a first home buyer, your initial loan served its purpose: getting you into the market. But as time passes, and you build equity through repayments and property value growth, refinancing can unlock significant benefits. Here are the common reasons why refinancing your mortgage is a smart move:

1. Secure a Better Interest Rate

Even a small reduction in your interest rate can save you thousands of dollars over the life of your loan. Lenders frequently offer competitive rates to attract new customers, and by refinancing, you can potentially switch to a lower rate than your current one. This is often the primary reason why refinance your home.

2. Change Your Loan Structure

Your needs might evolve. Perhaps you initially had a fixed-rate loan and now prefer the flexibility of a variable rate, or vice versa. Refinancing allows you to switch between loan types, split your loan into fixed and variable portions, or choose different repayment frequencies to better suit your budget.

3. Consolidate Other Debts

If you have higher-interest debts like credit card balances or personal loans, refinancing can allow you to roll these into your home loan. Since home loan interest rates are typically much lower, this can significantly reduce your overall monthly repayments and provide a clear path to becoming debt-free. This is a common reason to refinance your home.

4. Take Advantage of Different Features

Modern home loans come with a range of features like offset accounts, redraw facilities, and the ability to make extra repayments without penalty. If your current loan lacks these features or comes with high fees, refinancing to a more feature-rich product can offer greater flexibility and help you pay off your loan faster.

5. Unlock Equity

As you pay down your mortgage and your property value increases, you build equity. Refinancing can allow you to “cash out” some of this equity. This lump sum can be used for renovations, investments, or other significant expenses. This is a powerful reason why to refinance mortgage.

6. Add/Remove Borrowers

Life changes – relationships evolve, or a family member might want to join or leave the loan. Refinancing allows you to add or remove borrowers from the mortgage, updating the loan to reflect your current ownership structure. This also answers the question: should I refinance my home?

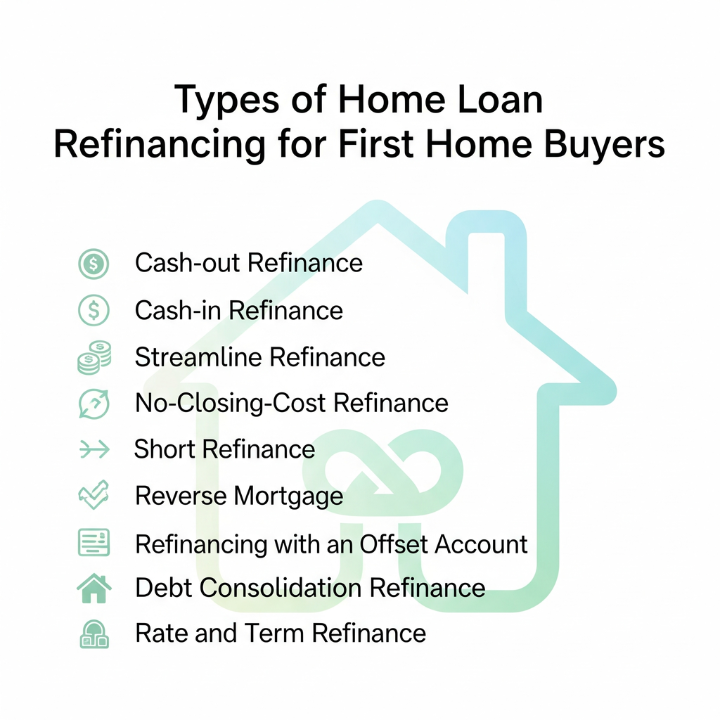

Types of Home Loan Refinancing for First Home Buyers

Understanding the various refinancing structures can help first-time borrowers identify what’s possible for their situation. Here’s an overview of common refinance home loan options:

Cash-out Refinance

A cash-out refinance involves taking out a new loan for more than your current outstanding balance, with the difference being paid to you in cash. This allows you to access the equity built up in your property. For example, if your home is worth $700,000, your loan is $400,000, and you qualify for an 80% LVR, you could potentially borrow up to $560,000, receiving $160,000 in cash.

Cash-in Refinance

Less common, a cash-in refinance involves making an additional lump sum payment towards your loan principal when refinancing. This typically occurs when you want to reduce your loan-to-value ratio (LVR) to gain access to a lower interest rate or avoid LMI on the new loan.

Streamline Refinance

While less common in Australia as a specific product name compared to the US, the concept of a “streamline refinance” refers to a quick and simplified refinancing process. This might apply when you’re staying with the same lender or if you have strong equity and an excellent repayment history, leading to minimal documentation and a faster turnaround.

No-Closing-Cost Refinance

Some lenders may offer “no-closing-cost” refinancing, where they absorb some or all of the upfront fees (like application fees or valuation costs) in exchange for a slightly higher interest rate, or as a promotional offer. While attractive initially, it’s crucial to compare the long-term cost with a loan that has upfront fees but a lower ongoing rate.

Short Refinance

A short refinance is not common in Australia and typically refers to a situation where a lender agrees to accept less than the full outstanding mortgage balance from a new lender when the property is underwater (worth less than the loan amount). This is usually a last resort in extreme financial hardship.

Reverse Mortgage

A reverse mortgage allows older homeowners (usually 60+) to access the equity in their home as a lump sum, regular payments, or a line of credit, without having to sell the property. The loan is typically repaid when the house is sold or the borrower passes away. This is not a common refinance option for first home buyers, as it’s designed for retirement income.

Refinancing with an Offset Account

This involves refinancing to a loan that offers an offset account feature. An offset account is a transaction account linked to your home loan, where the balance in the account “offsets” the principal amount on which you are charged interest. For example, if you owe $400,000 but have $50,000 in your offset, you only pay interest on $350,000, helping you pay off your loan faster and save interest.

Debt Consolidation Refinance

As mentioned above, this involves rolling other higher-interest debts (like personal loans, credit cards, or car loans) into your home loan during the refinancing process. This can simplify your finances into a single, lower-interest repayment.

Rate and Term Refinance

This is the most common type of refinancing, where the primary goal is to change the interest rate (to a lower one) or the loan term (to a longer or shorter period). It’s purely about optimising the core elements of your mortgage loan refinance without cashing out equity for other purposes. This is where mortgage refinance comparison is key to finding the best mortgage refinance or best refinance home loans.

When Should First Home Buyers Refinance? (Waiting Periods Explained)

Knowing when to refinance a mortgage is crucial for first-time home buyers. While you might be eager to switch immediately after settlement, it’s generally recommended to wait at least 6 to 12 months, or sometimes longer, before initiating a refinance home loan. Here’s why:

- Equity Growth: It takes time to build sufficient equity, both through loan repayments and potential property value appreciation. Lenders prefer a lower Loan-to-Value Ratio (LVR) when refinancing, typically aiming for 80% or below to avoid Lenders Mortgage Insurance (LMI) again.

- Costs: Refinancing comes with costs (discharge fees, new application fees, government charges – more on this below). You need enough time for the savings from a new loan to outweigh these upfront costs.

- Lender Policies: Some lenders have policies that penalise very early refinancing or may simply prefer to see a stable repayment history with your current loan for a certain period.

When to Refinance a Mortgage– Key Triggers:

- Ending Fixed Rate: If you’re on a fixed-rate home loan, the end of your fixed term is an ideal time to refinance. You can avoid significant break costs that apply if you exit early.

- Interest Rates Dropped: If the Reserve Bank of Australia (RBA) or market conditions lead to a significant drop in interest rates, your current loan might no longer be competitive. This is a prime time to explore how refinancing work.

- Have Built Equity: Once your property value has increased, or you’ve made substantial repayments, your LVR will be lower. This makes you a more attractive borrower and can open up better interest rates and features.

- Credit Score or Income Improved: If your financial situation has significantly improved since you first bought your home (e.g., higher income, improved credit score), you’re likely to qualify for better loan products. This directly impacts when you can refinance a home loan.

- Want Different Features: As your financial goals evolve, you might realise you need features like an offset account or redraw facility that your current loan doesn’t offer.

Switching from First Home Buyer Loans to Standard Loans

Many first home buyers initially enter the market with the help of specific government schemes (like the First Home Guarantee Scheme), low-deposit loans, or introductory rates. These loans are fantastic for getting your foot in the door. However, once you’ve built equity and established a solid repayment history, you’re often in a strong position to switch home loan to a standard, more competitive product.

Why First Home Buyers Start with Special Loans:

These loans typically offer:

- Lower deposit requirements (e.g., 5% with government guarantee, avoiding LMI).

- Access to grants and concessions (e.g., First Home Owner Grant, stamp duty concessions).

- Sometimes, specific introductory interest rates may revert to higher rates later.

Why Switch to a Standard Loan? Once you’ve built significant equity (ideally 20% or more), switching home loans to a standard product can provide:

- Better Rates: Access to the most competitive interest rates on the market, as you’re no longer considered a “high-LVR” borrower.

- No LMI: If you’ve reached 20% equity, you can avoid LMI on the new loan, saving you thousands of dollars.

- More Flexibility: Standard loans often come with a wider range of features like 100% offset accounts, unlimited extra repayments, and redraw facilities, which can help you pay off your loan faster.

- Wider Choice: You’ll have access to a broader selection of lenders and loan products.

When Should You Switch? Consider switching home loans from one bank to another when:

- You have at least 15-20% equity in your property.

- Your introductory fixed rate is ending.

- Market interest rates have dropped.

- Your financial situation (income, credit score) has improved significantly.

Tips for a Smooth Switch:

- Assess your equity: Get an up-to-date valuation of your property.

- Check your credit score: A good score will open more doors.

- Review your current loan: Understand any exit fees or break costs.

- Work with a broker: They can compare options across many lenders and manage the process.

Debt Recycling Strategies for First Home Buyers

Debt recycling Australia is a sophisticated financial strategy that first home buyers can consider once they’ve built sufficient equity in their home. It involves strategically converting non-tax-deductible debt (like your home loan) into tax-deductible debt used for investment purposes.

What Is Debt Recycling?

Debt recycling is the process of paying down your non-deductible home loan with your excess cash flow, then re-borrowing that same amount to invest in income-producing assets (like shares or an investment property). The interest on the newly borrowed money, used for investment, typically becomes tax-deductible. The goal is to gradually convert your personal debt into “investment debt,” which can lead to tax savings and accelerate wealth creation.

How Does Debt Recycling Work?

- Pay Down Your Home Loan: Use any extra money you have (e.g., from savings, salary bonuses, or a pay rise) to make additional repayments on your non-deductible principal and interest home loan.

- Re-draw or Re-finance: Once you’ve built up enough redraw facility or equity, you can either redraw those extra funds or refinance your home loan to a new, larger loan.

- Invest the Funds: Crucially, the re-borrowed funds must be used solely for income-producing investments (e.g., shares that pay dividends, a rental property).

- Claim Interest Deduction: The interest paid on the portion of your loan specifically used for these investments becomes tax-deductible, reducing your taxable income.

This effectively answers how to recycle debt.

Why First Home Buyers Consider Debt Recycling

- Tax Efficiency: Converts non-deductible debt interest into tax-deductible interest, reducing your overall tax burden.

- Wealth Creation: Accelerates the growth of your investment portfolio by leveraging your home equity.

- Debt Reduction: The investment income can be used to pay down your non-deductible home loan further, speeding up debt repayment.

Things to Watch Out For

- Complexity: It’s a complex strategy that requires careful structuring and meticulous record-keeping.

- Investment Risk: You are investing borrowed money, so there’s a risk your investments could lose value, potentially leaving you with more debt than assets.

- Tax Compliance: Strict rules apply to tax deductibility. Any mixing of personal and investment funds can jeopardise the tax benefits.

- Requires Discipline: You need to be disciplined with your budget and investment choices.

Debt recycling is an advanced strategy and should only be pursued with comprehensive advice from a qualified financial planner and tax accountant, in conjunction with your mortgage broker. It’s not for everyone, and it’s vital to understand the risks involved.

How First Home Buyers Can Refinance: Step-by-Step Process

The refinance home loan process for first home buyers, while potentially rewarding, involves several steps. Here’s a clear breakdown:

1. Review Your Current Loan

Start by gathering all the details of your existing home loan. This includes your current interest rate, loan term, any ongoing fees, redraw facility, offset account features, and crucially, any potential exit fees or fixed-rate break costs if applicable. This step informs refinancing your mortgage decisions.

2. Check Your Equity

Your equity is the portion of your home you own outright. It’s calculated as your property’s current market value minus your outstanding loan balance. You can get an estimate through online valuations or by requesting a formal valuation from a lender. Building sufficient equity (ideally 20% or more) is key to accessing better refinance deals and avoiding LMI on the new loan.

3. Research the Market

This is where a mortgage broker truly shines. They will compare dozens of lenders and products to find the best refinance home loans and rates available to you based on your current financial situation, equity, and goals. You’ll want to look at interest rates (both variable and fixed), fees, and features like offset accounts. This comparison is vital for a mortgage refinance comparison.

4. Crunch the Numbers

Beyond the interest rate, consider all the costs associated with refinancing, including any exit fees from your current lender, new loan application fees, valuation fees, and government charges (like mortgage registration fees). A good broker will help you calculate if the long-term savings outweigh these upfront costs.

5. Apply for Pre-Approval

Once you’ve identified a potential new loan, your broker will help you apply for pre-approval. This involves submitting your financial documents (income, expenses, assets, liabilities) to the new lender. Pre-approval gives you confidence and a clearer picture of what you can borrow.

6. Property Valuation

The new lender will conduct a valuation of your property to confirm its current market value. This is a critical step in determining your LVR for the new loan.

7. Settlement & Switch

If your application is approved, the new lender will pay out your old loan. Legal processes will handle the transfer of the mortgage. Once settlement occurs, your loan has officially switched, and you’ll begin making repayments to your new lender under the new terms. This is how to refinance home loan effectively.

What to Check Before Refinancing

Before you jump into refinance home loan, a thorough check of these factors is essential to ensure you’re making a financially sound decision:

- Exit Fees: Your current lender might charge a discharge fee or exit fee.

- Break Costs: If you’re on a fixed-rate loan, breaking it early can incur substantial “break costs,” which can wipe out any potential savings.

- New Loan Fees: The new lender might have application fees, establishment fees, or an annual package fee if it’s a bundled product.

- LVR (Loan-to-Value Ratio): Understand your current LVR. If it’s still above 80%, you might need to pay Lenders Mortgage Insurance again with the new loan, which can be a significant cost.

- Valuations: Get an accurate, up-to-date valuation of your property to ensure you know your current equity position.

- Impacts on Cash Flow: While a lower interest rate can reduce repayments, ensure the new repayment frequency or structure fits your budget.

- Checking That Long-Term Outweighs Short-Term Costs: It’s vital to calculate the total cost of refinancing (including all fees) and compare it against the total interest savings you expect over the new loan term. A small upfront saving might not be worth significant long-term costs. This is where mortgage refinancing requires careful analysis.

Benefits vs Drawbacks of Refinancing

Refinancing can be a powerful financial tool, but it’s not without its downsides. Weighing the pros and cons of refinancing is crucial for first home buyers.

Pros

- Lower Repayments: The most common and direct benefit, freeing up cash flow.

- Interest Savings: Significant long-term savings over the life of the loan.

- Flexibility: Access to better loan features like offset accounts, redraw facilities, and split loan options.

- Equity Access: Ability to unlock built-up equity for other financial goals.

- Debt Consolidation: Simplify finances and reduce interest by rolling high-interest debts into your mortgage.

- Shorter Loan Term: Opportunity to potentially reduce your loan term if you maintain your old repayment amount or increase it.

Cons

- Fees and Costs: Can involve discharge fees, application fees, valuation fees, and government charges. These upfront costs need to be considered against potential savings.

- Longer Loan Term (Potential): If you refinance and extend your loan term back to 30 years, you could end up paying more interest overall, even with a lower rate. This is a key reason I should refinance my home, which needs careful thought.

- Using Equity Unwisely: Accessing equity for discretionary spending without a clear financial plan can lead to increased debt and slower wealth accumulation.

- Impact on Credit Score: A new loan application involves a credit inquiry, which can temporarily affect your score.

- Fixed Rate Break Costs: Potentially high costs if you’re breaking a fixed-rate loan early.

- Loss of Existing Features: You might lose some features you value on your old loan if the new one doesn’t offer them.

Understanding why to refinance your home always involves considering these trade-offs.

Tips to Nail Your First Home Buyer Refinancing

Refinancing, particularly for your first home, requires a strategic approach. Here are actionable tips to ensure you make the most of the process and find the best mortgage refinance deal:

- Check Your Credit Score Regularly: Before you even think about refinancing, get a free copy of your credit report. A good credit score will significantly improve your chances of approval and help you secure the best rates.

- Use a Broker (Highly Recommended): A mortgage broker has access to dozens of lenders and can compare products from across the market to find the most suitable and competitive option for you. They understand lender policies and can save you time and money.

- Compare Multiple Lenders: Don’t just stick with your current bank. Even if you don’t use a broker, research offers from at least three different lenders to ensure you’re getting a competitive deal. This is the essence of mortgage refinance comparison.

- Look for Cashback Offers: Many lenders offer cashback incentives for refinancing. While these can be attractive, ensure the underlying loan product and interest rate are still competitive in the long run.

- Negotiate Fees: Don’t be afraid to ask lenders (or your broker to ask on your behalf) if they can waive or reduce certain fees, especially establishment or application fees.

- Stay Disciplined with New Borrowing: If you consolidate debt or cash out equity, be disciplined. The goal is to improve your financial position, not to accrue more debt unnecessarily.

- Understand the “True” Cost: Look beyond just the advertised interest rate. Factor in all fees, charges, and the new loan term to understand the actual cost over the life of the loan. This is key to refinance a home loan effectively.

Why Should You Hire a Professional Broker for First Home Buyer Refinancing?

Refinancing isn’t as straightforward as it might seem, especially for first home buyers who are still learning the ropes of the mortgage market. Hiring a professional broker like Capkon Melbourne can be invaluable:

- Compare Dozens of Lenders for You: Instead of you spending hours researching and comparing, a broker has access to a vast network of lenders (including major banks and specialist lenders) and can quickly identify the most suitable products for your unique situation.

- Know When to Refinance: Brokers understand market trends, interest rate movements, and individual lender policies, advising you on the optimal time to refinance home loan to maximise your savings.

- Help You Structure Your Loan Properly: Whether you want to switch to a variable rate, set up an offset account, or explore debt recycling, a broker can help structure your new loan to align with your financial goals.

- They Handle the Paperwork and the Bank: Refinancing involves a fair bit of documentation and communication. Your broker manages this process, saving you time and stress.

- They’re Usually Free for You: Mortgage brokers are typically paid by the lender upon successful settlement of your loan, meaning their services are usually at no direct cost to you.

- They Spot Hidden Costs: Brokers are adept at identifying all the potential fees and charges associated with refinancing, ensuring you have a complete picture of the costs involved in mortgage refinancing.

- Local Expertise: As Melbourne-based experts, Capkon understands the local property market and lending landscape, offering tailored advice for residents in our city.

Capkon Melbourne is a trusted mortgage broker in Melbourne with deep experience helping first home buyers and existing homeowners achieve their financial goals through smart refinancing strategies.

Final Thoughts

Your first mortgage is a significant commitment, but it doesn’t have to be forever. As a first home buyer, leveraging the power of refinance home loan strategies can put you in a stronger financial position, allowing you to save money, shorten your loan term, or build wealth smarter through strategies like debt recycling. The key is to be proactive and informed.

Whether you’re looking to reduce your monthly repayments, access equity for renovations, or simply optimise your loan structure, the options are there.

Need Help in Refinancing? Talk to Capkon’s Melbourne Mortgage Experts Today

Don’t leave potential savings on the table. If you’re a first home buyer or an existing homeowner in Melbourne considering your refinancing options, Capkon is here to provide expert, personalised guidance. Our local expertise and commitment to finding the best refinance home loans tailored to your individual needs ensure you get the best possible outcome.

Contact Capkon Melbourne today to book a free consultation or get a free assessment. Let us help you unlock the full potential of your home loan.

FAQs

Q: Should I refinance my first home loan?

A: You should definitely consider it! Many first home buyers start with loans tailored to get them into the market. After some time, as your equity grows and your financial situation improves, refinancing can lead to significant savings on interest, lower repayments, or access to beneficial loan features.

Q: When can I refinance my first home loan?

A: While there’s no strict rule, it’s generally recommended to wait at least 6 to 12 months after your initial purchase. This allows you to build some equity and establish a stable repayment history. You should also consider refinancing when your fixed-rate period is ending, interest rates have dropped, or your financial situation (income, credit score) has improved.

Q: What are the benefits of refinancing as a first home buyer?

A: Key benefits include securing a better interest rate, reducing your monthly repayments, gaining access to beneficial loan features like offset accounts, consolidating other higher-interest debts, and potentially unlocking equity for other purposes like renovations or investments.

Q: Can I switch from a first home buyer loan to a standard loan?

A: Yes, absolutely. Many first home buyers begin with government-backed schemes or low-deposit loans. Once you build sufficient equity (ideally 20% or more), you can switch to a standard loan with better interest rates and more flexible features, often avoiding Lenders Mortgage Insurance (LMI) on the new loan.

Q: What is debt recycling, and should first home buyers use it?

A: Debt recycling is a strategy where you use equity from your home loan to fund income-producing investments, making the interest on that portion of your loan tax-deductible. It’s an advanced strategy primarily for those with stable finances and a good understanding of investment risks. First home buyers can consider it once they’ve established sufficient equity and have received comprehensive financial and tax advice.

Q: How much does it cost to refinance my home loan?

A: Refinancing involves various costs, including:

- Discharge fees from your current lender (around $350).

- Fixed-rate break costs (can be substantial if you break early).

- New loan application/establishment fees (can be $0 to a few hundred dollars).

- Valuation fees (sometimes waived).

- Government fees like mortgage registration and discharge of mortgage fees (state-dependent).

- LMI (if your LVR is above 80% with the new loan). A good broker will help you calculate if the long-term savings outweigh these upfront costs.

Q: Will refinancing affect my First Home Owner Grant?

A: Generally, refinancing your home loan will not affect your First Home Owner Grant (FHOG), provided you have already fulfilled the grant’s occupancy requirements (usually living in the property as your principal place of residence for at least 6-12 months). The FHOG is a one-off payment for eligible new home purchases and is typically not impacted by subsequent refinancing.

Q: Can I use refinancing to consolidate other debts?

A: Yes, this is a common reason for refinancing. You can often roll higher-interest debts like credit card balances, personal loans, or car loans into your home loan during the refinancing process. This can significantly reduce your overall interest payments and simplify your monthly budgeting into a single repayment.

Q: How do I find the best mortgage refinance deals in Melbourne?

A: The best way to find the best mortgage refinance deals in Melbourne is to work with an experienced local mortgage broker like Capkon Melbourne. We have access to a wide range of lenders and products, understand the nuances of the Melbourne market, and can compare competitive rates and features tailored to your specific financial situation.

The property market of Australia remains an investor’s dream since it has a solid long-term appeal, especially in young markets such as the state of Victoria. In spite of the recent changes, the mood among investors is still positive and is fuelled by the long-term capital appreciation and rental returns. The key to success in a dynamic market is to make well-invested financial decisions. A comprehensive knowledge of investment property loans and the property investment market, however, is the key to the success of both average and experienced investors.

That is when Capkon comes in. With extensive experience and thorough knowledge of the Australian lending industry, we empower investors to navigate the complexities of finding the right investment property loan, ensuring all their financial plans align with their desired investment objectives.

What Is an Investment Property Loan and How Does It Work?

A loan on an investment property is tailored especially to obtain property that is to be rented out or raised in value rather than occupied by the owners. The loans have different characteristics associated with them, unlike an ordinary owner-occupier home loan, to which there are varying risk profiles and tax consequences.

In most cases, interest rates on investment home loans or property investment loans may be a bit higher than those of owner-occupier loans because mortgage lenders consider that there is more risk involved in investment properties. Tax treatment is also much different; interest paid on an investment loan is normally tax-deductible against rental income, which is important to the investor. The same is true in a residential investment loan situation and in a commercial property loan arrangement, but the details may be more complicated with commercial properties.

Who Can Apply for an Investment Loan? (And Who Should Consider It?)

As dreamy as the idea of owning an investment property might be, not all people qualify at once and are ready to be investors. They have certain criteria, and by acquaintance yourself with them, you can go very far and streamline your application to the bank. This is the list of what people can apply for to be granted an investment property loan, and what people should consider getting:

- Full-time Workers: It is the most preferred applicant category. Lenders would evaluate your income, employment, and financial obligations to identify your capacity to borrow.

- Self-Employed Individuals: Getting a self-employed investment loan is doable, but it just needs to be a greater level of documentation to show stable income. Financial statements and two years of regular income are a minimum that lenders require.

- Australian Expats: Most Australian expats want to invest in their native country. Although this is possible, it usually comes with tougher standards since it is not easy to establish the incomes earned abroad and face risks in foreign exchange issues.

- High-Earners: People who earn good incomes tend to have a better lending ability since most of their cases may be characterised by a lower debt-to-income ratio.

What Does It Mean to Be ‘Investment Ready’?

In addition to fulfilling the bare-bones financial requirements, to be investment-ready, you need:

- Financial Stability: A predictable income, a good credit record, and affordable outstanding debt.

- Transparent Financial Goals: Knowing whether you are in search of capital growth, a rental yield, or a mix of both.

- Market Knowledge: You have studied the property market, potential rental returns of the market, and risks involved.

- Emergency Fund: Having an amount of savings that can be used against an unexpected event or vacancy.

How Much Can You Borrow for an Investment Property in Australia?

Your investment property borrowing capacity is an important issue, and it is subject to several major considerations:

- Income: This will be the biggest motive. Mortgage providers count your total income from every source, such as your salary, wages, and even a part of the anticipated rent income of the investment property.

- Liabilities: Your current debts, which include personal loans, credit card debts, and other mortgages, greatly reduce your ability to borrow much lesser. Banks take your repayment obligations into account.

- Deposit: The more the amount deposited, the higher the probable amount that can be raised in terms of the loan, and more favourable interest rates are common.

- Equity: As a current homeowner, the equity you have is able to afford you to borrow more on an investment property.

Scenarios for LVR (Loan-to-Value Ratio):

- 90% LVR Loans: These are permissible but likely to entail Lenders Mortgage Insurance (LMI) and much more strenuous criteria to meet.

- 100% or 105% LVR Loans: “No deposit” loans on the investment home are not only difficult to get, they are also very strictly limited, though in some instances it is possible with a huge leveraged equity amount or a guarantor. These are associated, however, with greater risks and in many cases, greater costs.

The question of how much I can borrow for an investment property needs a thorough review of your financial position, and only a mortgage broker such as Capkon can give you an exact amount.

Investment Loan Deposit Requirements

There are four common areas or conditions that borrowers must meet in order to be able to secure an investment property loan. These are important factors that should be understood by a novice and experienced investor:

- Credit Score: The first thing is a good credit level. The lenders check your repayment record, current credit accounts, and defaults/bankruptcies. The higher the score, the lower the risk.

- Deposit: The 20% deposit is commonly given, but it is more of a guideline than a rule. Lenders look at how much of a significant amount of money you can guarantee them as an upfront fee, and by doing so, they will feel secure.

- Equity: You can also have up to huge equity in your current home, and this may be a plus for the existing homeowners. This equity could be substituted with a cash deposit in many cases.

- Income: Lenders must ensure that you can fully prove the existence of stable and sufficient income that will cover the loan repayments, even in the event of rental income. This is in the form of employment income, business income (where one is self-employed), and even a %age of the expected rental income.

In unique financial circumstances or non-standard applications, the worth of a mortgage broker in Melbourne, such as Capkon cannot be overestimated. We possess the expertise of bringing your application in the most favourable perspective and introducing you to more accommodating lenders. In the case of a lesser-known no-deposit investment loan, a broker can determine whether this possibility is feasible based on particular guarantor loan formats or upon the utilisation of an enormous existing equity. Such are very particular situations and need professional advice in order to cope with them.

First-Time Investor Considerations:

To a new investor, this lower deposit may be tempting, but it will pay to figure out the incremental cost of LMI against the reward of achieving entry into the market earlier. Capkon will be able to explain to you all the financial consequences of various potential investment property deposits and advise you whether or not a no-deposit investment loan strategy is viable for your situation.

To a new investor, this lower deposit may be tempting, but it will pay to figure out the incremental cost of LMI against the reward of achieving entry into the market earlier. Capkon will be able to explain to you all the financial consequences of various potential investment property deposits and advise you whether or not a no-deposit investment loan strategy is viable for your situation.

Lenders Mortgage Insurance (LMI)

When a deposit towards the purchase price of property is less than 20% of the property value, lenders charge a premium called Lenders Mortgage Insurance (LMI). In essence, it insures against losses that might have been made by the lender if you fail to honour your mortgage.

- Who pays for it? The LMI premium is paid by the borrower, usually, a lump sum after the loan, or it is capitalised into the loan amount (which, then, attracts interest).

- Under What Conditions? It is used when the LVR (Loan-to-Value Ratio) of yours is over 80 %. Therefore, when you borrow above 80% of the value of the property, chances are high that you will pay LMI.

- Professional Waivers: Some lenders allow a waiver of LMI based on income in certain professions, e.g,. doctors, accountants, lawyers, or other specified professions. This is attributed to a lower risk profile and the ability to earn more money. To provide an example, a doctor may make a 90% LVR investment property loan with no LMI, saving tens of thousands of dollars.

The costs of investing in property under LMI are imperative to understand when doing proper financial planning, and Capkon will assist you in finding out whether you can be allowed any waiver or reduce its impact.

Types of Investment Property Loans Available in Australia

A multitude of the types of investment property loan types are available in Australia, and each has its advantages and disadvantages regarding your investing strategy:

- Interest-Only Loans: At the interest-only stage (usually 1-5 years), you can only make payments to cover the interest being charged on the loan. This can greatly minimise the instant cash leakage, which is helpful to the investors with capital growth concerns as he/she is now capable of using the cash on other investments or expenses. The main equilibrium is, however, not diminished in the course of the period.

- Principal and interest (P&I) loans: In P&I loans, every repayment is partly to pay the principal loan and partly the interest. This implies that the balance of your loan will decline with time, increasing your equity more speedily.

- Fixed Rates: The rate of interest will be fixed at some level for a specific duration (e.g, 1-5 years). This provides you with repayment certainty, insulating you against rate increases, but not helping you with a rate decrease.

- Variable Rates: An interest rate can vary according to the market. That gives flexibility and gives the possibility of paying less if the rates fall, but at the same time puts you at the risk of rate rises.

- Line of Credit Loans: These are flexible loans through which a person can incur the amount of money they need up to a stipulated limit, and can repay the amount and redraw another time. They can be applied to both temporary investment plans and repairs and should be managed disciplinarily because they are open-ended.

- Offset Account: An account that is associated with your home loan. The balance in this account will pay off the amount of your loan, so that you pay less interest. By way of example, on an offset account, a loan of 500,000 dollars with 50,000 dollars in the offset account, you will pay the interest on 450,000 dollars.

- Redraw Facility: Enables you to get access to additional repayments that you have deposited on your loan. It can be of use in case of untimely expenses or investments.

There are many factors to consider when selecting the most appropriate investment property loan, which mainly depend on your investment objectives, your level of risk, as well as cash flow position. Capkon can offer personalised guidance on the loan type that would best suit your strategy.

Using Equity to Buy an Investment Property

In the case of current homeowners, then using the capital of the current home can be a potent option for fund sourcing to purchase a new investment. This is where a part of the value of the house you have is unlocked without that house being sold.

- How it Works: There is equity in the home loan that you can take by refinancing your existing loan. This is usually in the form of growing your current mortgage or getting an additional loan called an equity loan.

- Calculating Equity: The amount of equity you have normally is the current market value of property minus the mortgage you still owe, once a margin has been taken out (usually a lending institution will permit you to utilise up to 80 per cent of the value of a property, but with LMI sometimes 90 percent or more).

Benefits:

- No Optional Cash Deposit: You may not have to cover a separate cash deposit for the investment property.

- Quicker Entry into the Market: It can hasten your entry into the market of investment market.

- Tax Savings: The interest on much of the loan you take out to invest in can be deducted as tax.

Risks:

- Increased Debt: You’re taking on more debt, which means higher repayments.

- Impact on Existing Home: Your primary residence is used as security for the new loan.

- Market Fluctuations: If property values decline, your equity could diminish, potentially leading to negative equity.

- Affects Borrowing Power: While it provides a deposit, the increased debt from an equity loan for investment also affects your overall borrowing power for future loans.

Capkon specialises in helping clients understand and utilise their existing property investment loans and equity to strategically grow their portfolio.

Key Factors Lenders Consider for Investment Loan Approval

When you apply for an investment loan, lenders undertake a meticulous assessment to gauge your ability to repay the debt. Here’s a detailed checklist of what they scrutinise:

- Credit History: A clean credit report with a history of timely repayments is crucial. Lenders examine your credit score, any past defaults, bankruptcy, or multiple loan inquiries.

- Income: Lenders assess all your income sources – employment income (salary, wages, bonuses), self-employed income (from your business), and a percentage of projected rental income from the investment property. They look for stability and consistency.

- Existing Liabilities: All your current financial commitments, including existing mortgages, personal loans, car loans, credit card debts, and even HECS/HELP debts, are factored in. These reduce your borrowing capacity.

- Property Type: The type of property you intend to buy (residential house, apartment, unit, or commercial space) influences the lender’s assessment. Certain property types or locations might be viewed as higher risk.

- Rental Income Projections: Lenders typically discount projected rental income (e.g., only counting 70-80% of it) to account for vacancies or unexpected expenses.

- Valuation: An independent valuation of the investment property is mandatory. This ensures the property’s market value aligns with the purchase price and provides the lender with confidence in their security.

For investment loan requirements and especially complex scenarios involving commercial investment property loan requirements, Capkon’s expertise is invaluable in preparing a strong application.

Investment Property Loan Repayments: How to Plan Effectively

Effective planning for your investment property loan repayments is crucial for long-term financial success. It goes beyond just knowing your monthly payment and involves strategic financial management.

- Understanding Interest Costs: Make note of the way interest is charged and of the effect it will have on your total payments. Although investment loans attract interest that is usually tax-deductible, it is still an outgoing.

- Tax Deductibility: The interest on the investment property loan you take out, as well as all other expenses such as property maintenance fees, council rates, and property management fees, are normally tax-deductible on your rental income.

- Negative Gearing: When the costs connected with your investment property (including the interest on the loan) are higher in comparison to the shown you get, you are reported to be negatively geared. This loss can be set against any other taxable income that you may have, therefore minimising your taxes. While it can be advantageous tax-wise, it does imply that the property is not cash flow positive short term.

- Cash Flow Forecasting: This is essential. Prepare an elaborate budget incorporating all the possibilities of income (rental) and expenses (loan repayments, rates, insurance, maintenance, and possible vacancies). Estimation of costs, such as interest, can be facilitated by tools such as online mortgage calculators. Daily updating of your cash flow will make you know about excesses or vacuums and make suitable adjustments in your strategy.

This strategic planning of the requirements in regard to the investment property-based loan and details of the commercial investment property-based loan requirements will position you to have greater financial control.

Investment Strategies: Capital Growth vs Rental Yield Focus

Your investment goals significantly influence the structure of your investment home loans and overall property investment loans strategy. Broadly, investors typically focus on two primary objectives:

Capital Growth Focus:

- Objective: To achieve appreciation in the property’s value over time.

- Characteristics: Often involves buying in areas with strong economic indicators, infrastructure development, and high demand, even if rental yields are lower.

- Loan Structure: Interest-only loans are often preferred here as they minimise immediate outgoings, allowing investors to free up cash for other investments or to hold the property longer until significant capital appreciation occurs.

- Strategy: Typically, a longer-term strategy, holding the property for several years or even decades.

Rental Yield Focus:

- Objective: To generate consistent rental income that ideally covers expenses and provides a positive cash flow.

- Characteristics: Involves buying in areas with stable tenant demand, affordable purchase prices relative to rent, and potentially lower capital growth prospects.

- Loan Structure: Principal and interest loans can be suitable, especially if the rental income comfortably covers repayments and contributes to accelerated equity build-up.

- Strategy: Can be shorter-term or long-term, depending on the investor’s cash flow needs.

Both residential investment loans and commercial property loans can be aligned with either of these strategies. Your choice depends on your financial situation, risk tolerance, and long-term wealth accumulation goals.

What Type of Property Should You Buy as an Investment?

The affordability of the investment property should not be the only factor that is considered when selecting the ideal investment property. The decision would be a factor in the attractiveness, care, and potential sustainability of the tenants.

- Homes: They are usually larger and have bigger and better land and capital appreciation prospects, of course, where it is desirable and posh. Nevertheless, they usually demand more costly maintenance and are more demanding to administer.

- Apartments/Units: These are usually cheaper, especially to first-time investors. They tend to experience smaller maintenance costs because of strata management, and can provide high returns in terms of rental locally. But capital appreciation may be slower, and there are strata fees, which are the continuous cost.

- Commercial Spaces: This may be more profitable in terms of rental returns and length of lease period than doing residential properties. They, however, are associated with greater vacancy risk and may require greater initial capital that is exposed to other market forces and funding needs.

- Development Potential: Seek out to put up properties that may have the potential for subdivision, upgrading, or adding to the property in the future. This can lead to a massive growth in capital.

- Maintenance Costs: Include recurring maintenance and repair charges. More costly older houses or those with certain facilities (e.g., swimming pools) may have higher costs.

- Tenant Appeal: think about what appeals to tenants in the neighbourhood, the transport, local schools, local amenities, and local centres of employment.

- Location Factors: Investigate the local demographics, employment levels, infrastructure-based projects, and supply/demand. An ambient place is a key to investment in properties.

Understanding how to get a mortgage loan for investment property for different asset classes is key, and Capkon can help you evaluate the best option for your strategy.

The Role of a Mortgage Broker in Securing Your Investment Loan

Investment property loan is a very complicated field to venture into. That is when an experienced investment property mortgage broker, such as Capkon, is very useful.

- Professional Advice: We are familiar with the dynamic environment related to lending, interest rates, and the specific lending requirements applied by any lending institution in regard of investment properties.

- Availability of a Greater Panel: We have access to a greater panel of lenders, major banks, second-tier lenders, and niche non-bank lenders. This implies that we will be in a position to compare thousands of products to arrive at the best loan offer to fit your specific needs, as opposed to being restricted to the offerings of a single bank.

- Customised Financing: We will listen to your financial objectives, tolerance to risks, and your strategy to provide a loan structure that suits you perfectly.

- Efficient Digital Application Process: We take you through the process of application, including pre-approval, down to closing, and all paperwork is correctly filled and complete, thus getting the loan approved sometimes quickly.

- Negotiation Power: Often, we can negotiate greater rates and terms with lenders using our good standing relationships.

In a word, when you are trying to find an answer to how to get a loan on an investment property, coming to Capkon will only maximise the probability of receiving the best loan possible with the least amount of inconvenience.

How to Apply for an Investment Property Loan

Applying for an investment property loan involves several key steps. Here’s a simple, detailed guide to help you through the process:

Pre-Approval:

- Purpose: This is your starting point. Pre-approval gives you an indication of how much you can borrow, allowing you to confidently search for properties within your budget.

- Process: You’ll provide your financial details (income, expenses, assets, liabilities) to a lender or, ideally, a mortgage broker like Capkon. They assess your eligibility and issue a conditional approval.

- Benefit: Shows real estate agents you’re a serious buyer and can act quickly when you find the right property.

Gathering Documentation:

- What’s Needed: You’ll need a range of documents, including proof of identity, income statements (payslips, tax returns, business financials), bank statements, existing loan statements, and details of any other assets and liabilities.

- Capkon’s Role: We assist you in compiling all necessary documents, ensuring nothing is missed, which prevents delays in the application process.

Choosing the Right Loan:

- Considerations: Based on your pre-approval and financial goals, you’ll decide on the loan type (interest-only vs P&I), interest rate type (fixed vs variable), and any desired features (offset account, redraw).

- Capkon’s Role: We present you with suitable options from various lenders, explaining the pros and cons of each, to help you make an informed decision.

Property Selection:

- The Search: With your pre-approval in hand, you actively search for and secure your ideal investment property.

- Valuation: Once you find a property, the lender will arrange for an independent valuation to ensure its market value aligns with the purchase price.

Final Approval and Settlement:

- Formal Application: Once the property is selected and valued, your formal loan application is submitted.

- Final Assessment: The lender conducts a final assessment of your financial situation and the property details.

- Settlement: Upon final approval, all legal and financial processes are completed, funds are disbursed, and the property officially becomes yours.

This step-by-step approach simplifies the process of how to apply for an investment loan and navigating investment property loan requirements, including the more specific commercial investment property loan requirements.

Final Thoughts: Build Wealth with the Right Loan Structure

Investing in property in Australia remains a cornerstone of wealth creation for many. The journey, however, is significantly influenced by the financial backbone you establish – your investment property loans.

Selecting an optimal loan structure, which fits your goals and financial condition, is not only the issue about obtaining funds; it is about laying down a robust path to accumulating wealth over time.

By having a rough concept of the different types of loan expectations based on property investment, deposits required, details of LMI and its structure, as well as different types of loans to suit your needs or requirements, this will enable you to make better decisions. The right loan will streamline your level of cash flow, stabilise your tax position, and finally put you in the right state to thrive in the lively Australian property market.

Capkon’s Expertise: Tailored Investment Loan Solutions for Every Investor

At Capkon, we pride ourselves on being more than just mortgage brokers; we are your strategic partners in property investment. Many years of experience working in the Australian lending market, being able to comprehend its fluctuations and intricacies.

Capkon has access to a wide range of lenders (and lending products) to ensure we match the right lender to your requirements, whether it is to find a lender that will meet standard lending requirements (to fit within the required lending parameters of most investment properties) or have other more specialised commercial investment property loan requirements. An in-depth insight and knowledge of the Australian property market, with inspiration for regional growth and triggers to growth.