Congratulations on buying your first home! It’s a huge achievement, but the journey doesn’t end there. Many first home buyers don’t realise that the home loan they initially secured doesn’t have to be their forever loan. In fact, after settling into your new property, you might be able to refinance your home loan to get a better deal, access equity, or manage your debts more smartly.

At Capkon Melbourne, we’re dedicated to helping first home buyers navigate the post-purchase landscape. This comprehensive guide will walk you through everything you need to know about mortgage refinancing in Australia, offering practical solutions from understanding how refinancing works to exploring advanced strategies like debt recycling. We’ll show you how refinancing your mortgage can significantly impact your financial future.

What Is First Home Buyer Refinancing and How Does it Work?

Refinancing, in simple terms, means replacing your existing home loan with a new one, often from a different lender. This new loan pays out your old loan, and you then make repayments to the new lender under new terms.

For first home buyers, refinancing holds particular significance. Often, your initial loan might have been a high-LVR (Loan-to-Value Ratio) product, part of a special government scheme, or an introductory offer designed to get you into the market. Once you’ve made a few repayments and your property value potentially increases (building equity), you’re in a stronger position to refinance to a more competitive, standard home loan.

Essentially, how does refinancing a home loan involves a new lender assessing your current financial situation, your property’s value, and your repayment history. If approved, the new lender “takes over” your mortgage, potentially offering a lower interest rate, different features, or even access to some of your accumulated equity. This process effectively answers the question of what refinancing a house is – it’s optimising your mortgage after you’ve established yourself as a homeowner.

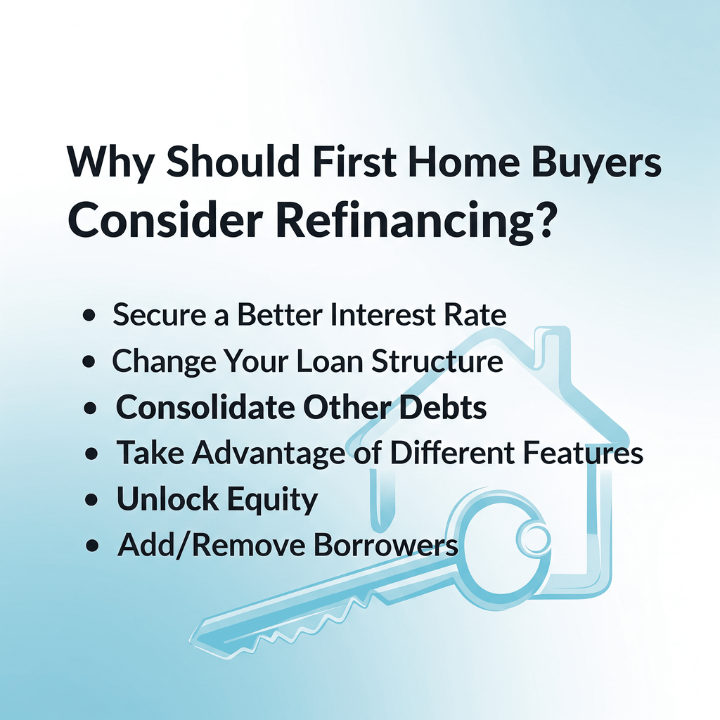

Why Should First Home Buyers Consider Refinancing?

As a first home buyer, your initial loan served its purpose: getting you into the market. But as time passes, and you build equity through repayments and property value growth, refinancing can unlock significant benefits. Here are the common reasons why refinancing your mortgage is a smart move:

1. Secure a Better Interest Rate

Even a small reduction in your interest rate can save you thousands of dollars over the life of your loan. Lenders frequently offer competitive rates to attract new customers, and by refinancing, you can potentially switch to a lower rate than your current one. This is often the primary reason why refinance your home.

2. Change Your Loan Structure

Your needs might evolve. Perhaps you initially had a fixed-rate loan and now prefer the flexibility of a variable rate, or vice versa. Refinancing allows you to switch between loan types, split your loan into fixed and variable portions, or choose different repayment frequencies to better suit your budget.

3. Consolidate Other Debts

If you have higher-interest debts like credit card balances or personal loans, refinancing can allow you to roll these into your home loan. Since home loan interest rates are typically much lower, this can significantly reduce your overall monthly repayments and provide a clear path to becoming debt-free. This is a common reason to refinance your home.

4. Take Advantage of Different Features

Modern home loans come with a range of features like offset accounts, redraw facilities, and the ability to make extra repayments without penalty. If your current loan lacks these features or comes with high fees, refinancing to a more feature-rich product can offer greater flexibility and help you pay off your loan faster.

5. Unlock Equity

As you pay down your mortgage and your property value increases, you build equity. Refinancing can allow you to “cash out” some of this equity. This lump sum can be used for renovations, investments, or other significant expenses. This is a powerful reason why to refinance mortgage.

6. Add/Remove Borrowers

Life changes – relationships evolve, or a family member might want to join or leave the loan. Refinancing allows you to add or remove borrowers from the mortgage, updating the loan to reflect your current ownership structure. This also answers the question: should I refinance my home?

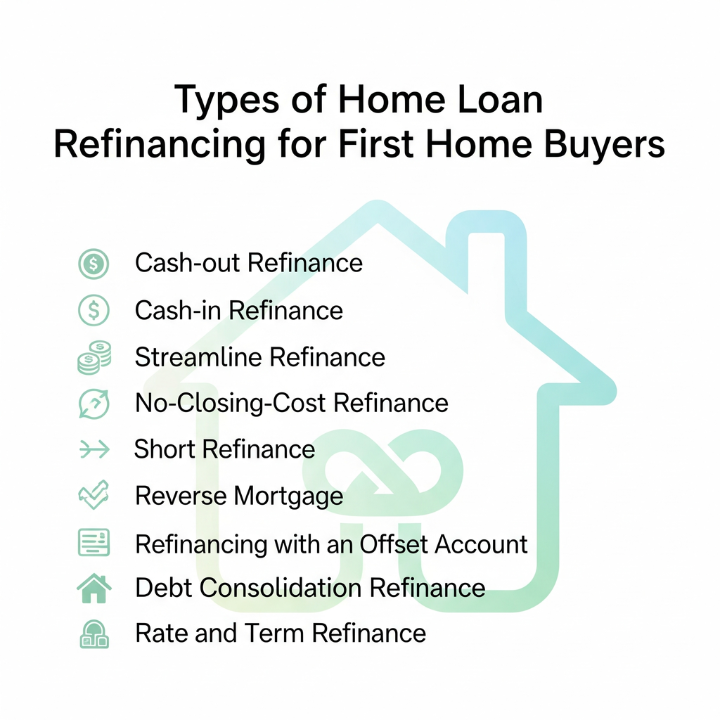

Types of Home Loan Refinancing for First Home Buyers

Understanding the various refinancing structures can help first-time borrowers identify what’s possible for their situation. Here’s an overview of common refinance home loan options:

Cash-out Refinance

A cash-out refinance involves taking out a new loan for more than your current outstanding balance, with the difference being paid to you in cash. This allows you to access the equity built up in your property. For example, if your home is worth $700,000, your loan is $400,000, and you qualify for an 80% LVR, you could potentially borrow up to $560,000, receiving $160,000 in cash.

Cash-in Refinance

Less common, a cash-in refinance involves making an additional lump sum payment towards your loan principal when refinancing. This typically occurs when you want to reduce your loan-to-value ratio (LVR) to gain access to a lower interest rate or avoid LMI on the new loan.

Streamline Refinance

While less common in Australia as a specific product name compared to the US, the concept of a “streamline refinance” refers to a quick and simplified refinancing process. This might apply when you’re staying with the same lender or if you have strong equity and an excellent repayment history, leading to minimal documentation and a faster turnaround.

No-Closing-Cost Refinance

Some lenders may offer “no-closing-cost” refinancing, where they absorb some or all of the upfront fees (like application fees or valuation costs) in exchange for a slightly higher interest rate, or as a promotional offer. While attractive initially, it’s crucial to compare the long-term cost with a loan that has upfront fees but a lower ongoing rate.

Short Refinance

A short refinance is not common in Australia and typically refers to a situation where a lender agrees to accept less than the full outstanding mortgage balance from a new lender when the property is underwater (worth less than the loan amount). This is usually a last resort in extreme financial hardship.

Reverse Mortgage

A reverse mortgage allows older homeowners (usually 60+) to access the equity in their home as a lump sum, regular payments, or a line of credit, without having to sell the property. The loan is typically repaid when the house is sold or the borrower passes away. This is not a common refinance option for first home buyers, as it’s designed for retirement income.

Refinancing with an Offset Account

This involves refinancing to a loan that offers an offset account feature. An offset account is a transaction account linked to your home loan, where the balance in the account “offsets” the principal amount on which you are charged interest. For example, if you owe $400,000 but have $50,000 in your offset, you only pay interest on $350,000, helping you pay off your loan faster and save interest.

Debt Consolidation Refinance

As mentioned above, this involves rolling other higher-interest debts (like personal loans, credit cards, or car loans) into your home loan during the refinancing process. This can simplify your finances into a single, lower-interest repayment.

Rate and Term Refinance

This is the most common type of refinancing, where the primary goal is to change the interest rate (to a lower one) or the loan term (to a longer or shorter period). It’s purely about optimising the core elements of your mortgage loan refinance without cashing out equity for other purposes. This is where mortgage refinance comparison is key to finding the best mortgage refinance or best refinance home loans.

When Should First Home Buyers Refinance? (Waiting Periods Explained)

Knowing when to refinance a mortgage is crucial for first-time home buyers. While you might be eager to switch immediately after settlement, it’s generally recommended to wait at least 6 to 12 months, or sometimes longer, before initiating a refinance home loan. Here’s why:

- Equity Growth: It takes time to build sufficient equity, both through loan repayments and potential property value appreciation. Lenders prefer a lower Loan-to-Value Ratio (LVR) when refinancing, typically aiming for 80% or below to avoid Lenders Mortgage Insurance (LMI) again.

- Costs: Refinancing comes with costs (discharge fees, new application fees, government charges – more on this below). You need enough time for the savings from a new loan to outweigh these upfront costs.

- Lender Policies: Some lenders have policies that penalise very early refinancing or may simply prefer to see a stable repayment history with your current loan for a certain period.

When to Refinance a Mortgage– Key Triggers:

- Ending Fixed Rate: If you’re on a fixed-rate home loan, the end of your fixed term is an ideal time to refinance. You can avoid significant break costs that apply if you exit early.

- Interest Rates Dropped: If the Reserve Bank of Australia (RBA) or market conditions lead to a significant drop in interest rates, your current loan might no longer be competitive. This is a prime time to explore how refinancing work.

- Have Built Equity: Once your property value has increased, or you’ve made substantial repayments, your LVR will be lower. This makes you a more attractive borrower and can open up better interest rates and features.

- Credit Score or Income Improved: If your financial situation has significantly improved since you first bought your home (e.g., higher income, improved credit score), you’re likely to qualify for better loan products. This directly impacts when you can refinance a home loan.

- Want Different Features: As your financial goals evolve, you might realise you need features like an offset account or redraw facility that your current loan doesn’t offer.

Switching from First Home Buyer Loans to Standard Loans

Many first home buyers initially enter the market with the help of specific government schemes (like the First Home Guarantee Scheme), low-deposit loans, or introductory rates. These loans are fantastic for getting your foot in the door. However, once you’ve built equity and established a solid repayment history, you’re often in a strong position to switch home loan to a standard, more competitive product.

Why First Home Buyers Start with Special Loans:

These loans typically offer:

- Lower deposit requirements (e.g., 5% with government guarantee, avoiding LMI).

- Access to grants and concessions (e.g., First Home Owner Grant, stamp duty concessions).

- Sometimes, specific introductory interest rates may revert to higher rates later.

Why Switch to a Standard Loan? Once you’ve built significant equity (ideally 20% or more), switching home loans to a standard product can provide:

- Better Rates: Access to the most competitive interest rates on the market, as you’re no longer considered a “high-LVR” borrower.

- No LMI: If you’ve reached 20% equity, you can avoid LMI on the new loan, saving you thousands of dollars.

- More Flexibility: Standard loans often come with a wider range of features like 100% offset accounts, unlimited extra repayments, and redraw facilities, which can help you pay off your loan faster.

- Wider Choice: You’ll have access to a broader selection of lenders and loan products.

When Should You Switch? Consider switching home loans from one bank to another when:

- You have at least 15-20% equity in your property.

- Your introductory fixed rate is ending.

- Market interest rates have dropped.

- Your financial situation (income, credit score) has improved significantly.

Tips for a Smooth Switch:

- Assess your equity: Get an up-to-date valuation of your property.

- Check your credit score: A good score will open more doors.

- Review your current loan: Understand any exit fees or break costs.

- Work with a broker: They can compare options across many lenders and manage the process.

Debt Recycling Strategies for First Home Buyers

Debt recycling Australia is a sophisticated financial strategy that first home buyers can consider once they’ve built sufficient equity in their home. It involves strategically converting non-tax-deductible debt (like your home loan) into tax-deductible debt used for investment purposes.

What Is Debt Recycling?

Debt recycling is the process of paying down your non-deductible home loan with your excess cash flow, then re-borrowing that same amount to invest in income-producing assets (like shares or an investment property). The interest on the newly borrowed money, used for investment, typically becomes tax-deductible. The goal is to gradually convert your personal debt into “investment debt,” which can lead to tax savings and accelerate wealth creation.

How Does Debt Recycling Work?

- Pay Down Your Home Loan: Use any extra money you have (e.g., from savings, salary bonuses, or a pay rise) to make additional repayments on your non-deductible principal and interest home loan.

- Re-draw or Re-finance: Once you’ve built up enough redraw facility or equity, you can either redraw those extra funds or refinance your home loan to a new, larger loan.

- Invest the Funds: Crucially, the re-borrowed funds must be used solely for income-producing investments (e.g., shares that pay dividends, a rental property).

- Claim Interest Deduction: The interest paid on the portion of your loan specifically used for these investments becomes tax-deductible, reducing your taxable income.

This effectively answers how to recycle debt.

Why First Home Buyers Consider Debt Recycling

- Tax Efficiency: Converts non-deductible debt interest into tax-deductible interest, reducing your overall tax burden.

- Wealth Creation: Accelerates the growth of your investment portfolio by leveraging your home equity.

- Debt Reduction: The investment income can be used to pay down your non-deductible home loan further, speeding up debt repayment.

Things to Watch Out For

- Complexity: It’s a complex strategy that requires careful structuring and meticulous record-keeping.

- Investment Risk: You are investing borrowed money, so there’s a risk your investments could lose value, potentially leaving you with more debt than assets.

- Tax Compliance: Strict rules apply to tax deductibility. Any mixing of personal and investment funds can jeopardise the tax benefits.

- Requires Discipline: You need to be disciplined with your budget and investment choices.

Debt recycling is an advanced strategy and should only be pursued with comprehensive advice from a qualified financial planner and tax accountant, in conjunction with your mortgage broker. It’s not for everyone, and it’s vital to understand the risks involved.

How First Home Buyers Can Refinance: Step-by-Step Process

The refinance home loan process for first home buyers, while potentially rewarding, involves several steps. Here’s a clear breakdown:

1. Review Your Current Loan

Start by gathering all the details of your existing home loan. This includes your current interest rate, loan term, any ongoing fees, redraw facility, offset account features, and crucially, any potential exit fees or fixed-rate break costs if applicable. This step informs refinancing your mortgage decisions.

2. Check Your Equity

Your equity is the portion of your home you own outright. It’s calculated as your property’s current market value minus your outstanding loan balance. You can get an estimate through online valuations or by requesting a formal valuation from a lender. Building sufficient equity (ideally 20% or more) is key to accessing better refinance deals and avoiding LMI on the new loan.

3. Research the Market

This is where a mortgage broker truly shines. They will compare dozens of lenders and products to find the best refinance home loans and rates available to you based on your current financial situation, equity, and goals. You’ll want to look at interest rates (both variable and fixed), fees, and features like offset accounts. This comparison is vital for a mortgage refinance comparison.

4. Crunch the Numbers

Beyond the interest rate, consider all the costs associated with refinancing, including any exit fees from your current lender, new loan application fees, valuation fees, and government charges (like mortgage registration fees). A good broker will help you calculate if the long-term savings outweigh these upfront costs.

5. Apply for Pre-Approval

Once you’ve identified a potential new loan, your broker will help you apply for pre-approval. This involves submitting your financial documents (income, expenses, assets, liabilities) to the new lender. Pre-approval gives you confidence and a clearer picture of what you can borrow.

6. Property Valuation

The new lender will conduct a valuation of your property to confirm its current market value. This is a critical step in determining your LVR for the new loan.

7. Settlement & Switch

If your application is approved, the new lender will pay out your old loan. Legal processes will handle the transfer of the mortgage. Once settlement occurs, your loan has officially switched, and you’ll begin making repayments to your new lender under the new terms. This is how to refinance home loan effectively.

What to Check Before Refinancing

Before you jump into refinance home loan, a thorough check of these factors is essential to ensure you’re making a financially sound decision:

- Exit Fees: Your current lender might charge a discharge fee or exit fee.

- Break Costs: If you’re on a fixed-rate loan, breaking it early can incur substantial “break costs,” which can wipe out any potential savings.

- New Loan Fees: The new lender might have application fees, establishment fees, or an annual package fee if it’s a bundled product.

- LVR (Loan-to-Value Ratio): Understand your current LVR. If it’s still above 80%, you might need to pay Lenders Mortgage Insurance again with the new loan, which can be a significant cost.

- Valuations: Get an accurate, up-to-date valuation of your property to ensure you know your current equity position.

- Impacts on Cash Flow: While a lower interest rate can reduce repayments, ensure the new repayment frequency or structure fits your budget.

- Checking That Long-Term Outweighs Short-Term Costs: It’s vital to calculate the total cost of refinancing (including all fees) and compare it against the total interest savings you expect over the new loan term. A small upfront saving might not be worth significant long-term costs. This is where mortgage refinancing requires careful analysis.

Benefits vs Drawbacks of Refinancing

Refinancing can be a powerful financial tool, but it’s not without its downsides. Weighing the pros and cons of refinancing is crucial for first home buyers.

Pros

- Lower Repayments: The most common and direct benefit, freeing up cash flow.

- Interest Savings: Significant long-term savings over the life of the loan.

- Flexibility: Access to better loan features like offset accounts, redraw facilities, and split loan options.

- Equity Access: Ability to unlock built-up equity for other financial goals.

- Debt Consolidation: Simplify finances and reduce interest by rolling high-interest debts into your mortgage.

- Shorter Loan Term: Opportunity to potentially reduce your loan term if you maintain your old repayment amount or increase it.

Cons

- Fees and Costs: Can involve discharge fees, application fees, valuation fees, and government charges. These upfront costs need to be considered against potential savings.

- Longer Loan Term (Potential): If you refinance and extend your loan term back to 30 years, you could end up paying more interest overall, even with a lower rate. This is a key reason I should refinance my home, which needs careful thought.

- Using Equity Unwisely: Accessing equity for discretionary spending without a clear financial plan can lead to increased debt and slower wealth accumulation.

- Impact on Credit Score: A new loan application involves a credit inquiry, which can temporarily affect your score.

- Fixed Rate Break Costs: Potentially high costs if you’re breaking a fixed-rate loan early.

- Loss of Existing Features: You might lose some features you value on your old loan if the new one doesn’t offer them.

Understanding why to refinance your home always involves considering these trade-offs.

Tips to Nail Your First Home Buyer Refinancing

Refinancing, particularly for your first home, requires a strategic approach. Here are actionable tips to ensure you make the most of the process and find the best mortgage refinance deal:

- Check Your Credit Score Regularly: Before you even think about refinancing, get a free copy of your credit report. A good credit score will significantly improve your chances of approval and help you secure the best rates.

- Use a Broker (Highly Recommended): A mortgage broker has access to dozens of lenders and can compare products from across the market to find the most suitable and competitive option for you. They understand lender policies and can save you time and money.

- Compare Multiple Lenders: Don’t just stick with your current bank. Even if you don’t use a broker, research offers from at least three different lenders to ensure you’re getting a competitive deal. This is the essence of mortgage refinance comparison.

- Look for Cashback Offers: Many lenders offer cashback incentives for refinancing. While these can be attractive, ensure the underlying loan product and interest rate are still competitive in the long run.

- Negotiate Fees: Don’t be afraid to ask lenders (or your broker to ask on your behalf) if they can waive or reduce certain fees, especially establishment or application fees.

- Stay Disciplined with New Borrowing: If you consolidate debt or cash out equity, be disciplined. The goal is to improve your financial position, not to accrue more debt unnecessarily.

- Understand the “True” Cost: Look beyond just the advertised interest rate. Factor in all fees, charges, and the new loan term to understand the actual cost over the life of the loan. This is key to refinance a home loan effectively.

Why Should You Hire a Professional Broker for First Home Buyer Refinancing?

Refinancing isn’t as straightforward as it might seem, especially for first home buyers who are still learning the ropes of the mortgage market. Hiring a professional broker like Capkon Melbourne can be invaluable:

- Compare Dozens of Lenders for You: Instead of you spending hours researching and comparing, a broker has access to a vast network of lenders (including major banks and specialist lenders) and can quickly identify the most suitable products for your unique situation.

- Know When to Refinance: Brokers understand market trends, interest rate movements, and individual lender policies, advising you on the optimal time to refinance home loan to maximise your savings.

- Help You Structure Your Loan Properly: Whether you want to switch to a variable rate, set up an offset account, or explore debt recycling, a broker can help structure your new loan to align with your financial goals.

- They Handle the Paperwork and the Bank: Refinancing involves a fair bit of documentation and communication. Your broker manages this process, saving you time and stress.

- They’re Usually Free for You: Mortgage brokers are typically paid by the lender upon successful settlement of your loan, meaning their services are usually at no direct cost to you.

- They Spot Hidden Costs: Brokers are adept at identifying all the potential fees and charges associated with refinancing, ensuring you have a complete picture of the costs involved in mortgage refinancing.

- Local Expertise: As Melbourne-based experts, Capkon understands the local property market and lending landscape, offering tailored advice for residents in our city.

Capkon Melbourne is a trusted mortgage broker in Melbourne with deep experience helping first home buyers and existing homeowners achieve their financial goals through smart refinancing strategies.

Final Thoughts

Your first mortgage is a significant commitment, but it doesn’t have to be forever. As a first home buyer, leveraging the power of refinance home loan strategies can put you in a stronger financial position, allowing you to save money, shorten your loan term, or build wealth smarter through strategies like debt recycling. The key is to be proactive and informed.

Whether you’re looking to reduce your monthly repayments, access equity for renovations, or simply optimise your loan structure, the options are there.

Need Help in Refinancing? Talk to Capkon’s Melbourne Mortgage Experts Today

Don’t leave potential savings on the table. If you’re a first home buyer or an existing homeowner in Melbourne considering your refinancing options, Capkon is here to provide expert, personalised guidance. Our local expertise and commitment to finding the best refinance home loans tailored to your individual needs ensure you get the best possible outcome.

Contact Capkon Melbourne today to book a free consultation or get a free assessment. Let us help you unlock the full potential of your home loan.

FAQs

Q: Should I refinance my first home loan?

A: You should definitely consider it! Many first home buyers start with loans tailored to get them into the market. After some time, as your equity grows and your financial situation improves, refinancing can lead to significant savings on interest, lower repayments, or access to beneficial loan features.

Q: When can I refinance my first home loan?

A: While there’s no strict rule, it’s generally recommended to wait at least 6 to 12 months after your initial purchase. This allows you to build some equity and establish a stable repayment history. You should also consider refinancing when your fixed-rate period is ending, interest rates have dropped, or your financial situation (income, credit score) has improved.

Q: What are the benefits of refinancing as a first home buyer?

A: Key benefits include securing a better interest rate, reducing your monthly repayments, gaining access to beneficial loan features like offset accounts, consolidating other higher-interest debts, and potentially unlocking equity for other purposes like renovations or investments.

Q: Can I switch from a first home buyer loan to a standard loan?

A: Yes, absolutely. Many first home buyers begin with government-backed schemes or low-deposit loans. Once you build sufficient equity (ideally 20% or more), you can switch to a standard loan with better interest rates and more flexible features, often avoiding Lenders Mortgage Insurance (LMI) on the new loan.

Q: What is debt recycling, and should first home buyers use it?

A: Debt recycling is a strategy where you use equity from your home loan to fund income-producing investments, making the interest on that portion of your loan tax-deductible. It’s an advanced strategy primarily for those with stable finances and a good understanding of investment risks. First home buyers can consider it once they’ve established sufficient equity and have received comprehensive financial and tax advice.

Q: How much does it cost to refinance my home loan?

A: Refinancing involves various costs, including:

- Discharge fees from your current lender (around $350).

- Fixed-rate break costs (can be substantial if you break early).

- New loan application/establishment fees (can be $0 to a few hundred dollars).

- Valuation fees (sometimes waived).

- Government fees like mortgage registration and discharge of mortgage fees (state-dependent).

- LMI (if your LVR is above 80% with the new loan). A good broker will help you calculate if the long-term savings outweigh these upfront costs.

Q: Will refinancing affect my First Home Owner Grant?

A: Generally, refinancing your home loan will not affect your First Home Owner Grant (FHOG), provided you have already fulfilled the grant’s occupancy requirements (usually living in the property as your principal place of residence for at least 6-12 months). The FHOG is a one-off payment for eligible new home purchases and is typically not impacted by subsequent refinancing.

Q: Can I use refinancing to consolidate other debts?

A: Yes, this is a common reason for refinancing. You can often roll higher-interest debts like credit card balances, personal loans, or car loans into your home loan during the refinancing process. This can significantly reduce your overall interest payments and simplify your monthly budgeting into a single repayment.

Q: How do I find the best mortgage refinance deals in Melbourne?

A: The best way to find the best mortgage refinance deals in Melbourne is to work with an experienced local mortgage broker like Capkon Melbourne. We have access to a wide range of lenders and products, understand the nuances of the Melbourne market, and can compare competitive rates and features tailored to your specific financial situation.