Refinancing your home loan can be a smart financial move, but it isn’t always the right choice. From lowering your interest rate to accessing equity, there are times when refinancing your home loan can save you thousands. However, in other cases, costs and risks may outweigh the benefits.

At Capkon Melbourne, we help borrowers decide when to refinance their home loans and when to hold back. Let’s explore the key situations that determine the right timing and strategy for a home loan refinance.

What Does It Mean to Refinance Your Home Loan?

Refinancing your home loan means you replace your existing mortgage with a new one that has different terms. This can be done with your current lender (an “internal refinance”) or, more commonly, by switching to a different lender entirely (an “external refinance”).

The goal is to secure more favourable terms to improve your financial position.

Common Reasons for a Home Loan Refinance:

- Lower Interest Rate: To reduce monthly repayments and total interest paid.

- Better Loan Features: To gain access to features like an offset account or a redraw facility.

- Consolidating Debts: To roll high-interest personal loans or credit card debt into your mortgage’s lower interest rate.

- Accessing Equity: To borrow extra funds for major expenses like renovations or investment property deposits.

Example: If you have a $500,000 loan at 6.50% and refinance to a new loan at 5.70%, you could save hundreds on your monthly repayments and tens of thousands of dollars in interest over the life of the loan. This is an example of how to refinance your home loan to secure better terms.

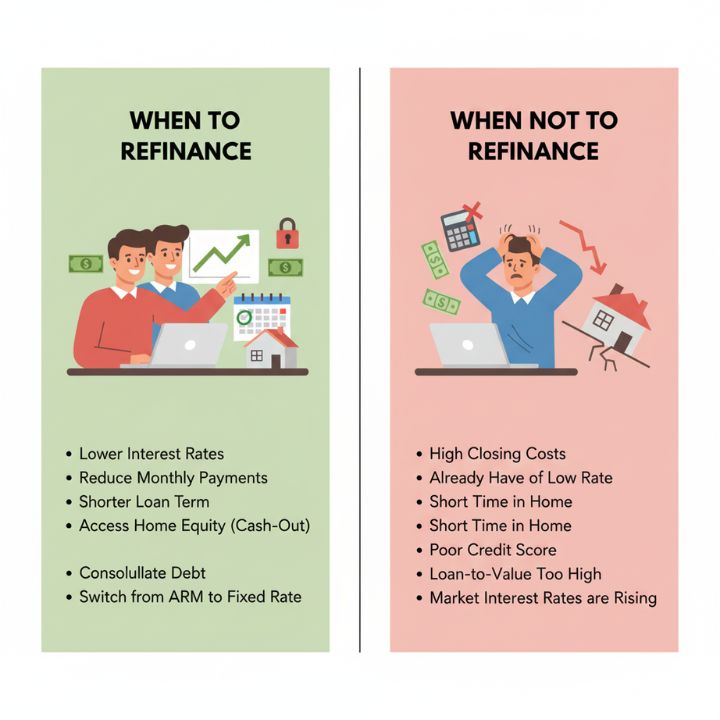

When Should You Refinance Your Home Loan?

Knowing when is the best time to refinance your home loan can make a significant difference to your finances. Here are key situations where a home loan refinance makes sense:

- Interest Rates Have Dropped: If market rates for new loans are significantly lower than your current rate.

- Your Introductory Rate is Ending: If you’re on a fixed rate or an introductory variable rate that is about to revert to a higher standard variable rate.

- Your Credit Score Has Improved: A better credit history can qualify you for the most competitive rates and products.

- You Need Flexible Features: If your current loan lacks features like an offset account (which can reduce interest) or a flexible redraw facility.

- You’re Consolidating High-Interest Debts: Using your home loan’s lower interest rate to pay off personal loans or credit cards.

- You’re Accessing Equity: You’ve built up substantial equity and want to cash out for purposes like home renovations or depositing in an investment property.

Example: Switching from a 6.00% rate to a 5.50% rate on a $400,000 loan could save you over $100 per month. Over 25 years, this seemingly small saving totals over $30,000 in interest, demonstrating when you should refinance your home loan.

Refinancing vs. Staying With Your Current Lender

When considering a refinance of your home loan, you have two main options: switch lenders or negotiate with your existing one.

Benefits of Refinancing (Switching Lenders):

- Access to the lowest market rates and most attractive features from competing lenders.

- Opportunity to consolidate debts and access equity.

- Potential for cashback incentives offered by the new lender.

Advantages of Staying Put (Internal Refinance/Negotiation):

- Loyalty Discounts: Your current lender may offer you a discounted rate to keep your business.

- Avoiding Fees: An internal refinance often avoids many of the switching fees (like discharge fees) associated with moving to a new lender.

- Stability: A simpler, faster process with less paperwork and no new credit enquiry.

Who Benefits Most?

- Refinancing: Long-term borrowers with large balances, or those whose current lender refuses to offer a competitive rate or the required features.

- Staying: Borrowers close to the end of their term, those who value simplicity, or those who can negotiate a sharp discount from their existing bank.

Capkon’s Approach: We assess both options by helping you negotiate with your current bank while also comparing the best deals on the market. Our goal is to ensure you don’t switch unnecessarily, but only when the financial benefits are clear.

When Not to Refinance Your Home Loan

A home loan refinance is a good idea when the savings outweigh the costs. Here are situations when you should not refinance your home loan:

- Near the End of Your Loan Term: If you only have a few years left, the cost of switching is unlikely to be offset by interest savings.

- Break Fees Outweigh Savings: If you are on a fixed-rate loan, the break costs can be extremely high, making a refinance financially unviable.

- Selling Your Property Soon: If you plan to sell within a year or two, you won’t have enough time to reach your breakeven point (the point at which your savings equal the switching costs).

- Worsened Financial Situation: If your income is unstable or you’ve taken on significant new debt, a new lender may reject your application or only offer a higher, non-competitive rate.

Warning: Refinancing isn’t always the cheapest option long-term if you repeatedly lengthen your loan term to lower repayments. This increases the total interest paid over the loan’s life.

What Do You Need to Refinance Your Home Loan?

Before applying, prepare the necessary documentation to ensure a smooth process. Knowing what you need to refinance your home loan is the first step in how to refinance your home loan in Australia.

Key Requirements:

- Stable Income and Employment: Payslips (usually the last 2-3 months), Group Certificate/PAYG Summary, or tax returns for self-employed individuals.

- Good Credit History: Lenders will assess your credit file. Too many recent credit enquiries or defaults can negatively impact your application.

- Proof of Property Value (Valuation): The new lender will conduct a valuation to determine your Loan-to-Value Ratio (LVR).

- Loan Documentation: Statements for your current home loan and any debts you plan to consolidate.

- Identification: Driver’s licence, passport, etc.

- Living Expenses: Documentation or a detailed breakdown of your monthly expenses.

The lender assessment involves a thorough review of your financial situation to ensure the new loan is affordable, as required by law.

Steps on How to Refinance Your Home Loan in Australia

The process of a home loan refinance generally follows these five steps:

Step 1: Review Your Current Loan- Examine your existing loan’s interest rate, annual fees, loan features, and any potential exit or discharge fees. Determine your primary goal (e.g., lower rate, new features, or equity access).

Step 2: Compare Lenders and Products- Shop around or work with a mortgage broker like Capkon Melbourne to compare the interest rates and features of loans from different institutions. Focus on the comparison rate, not just the advertised rate.

Step 3: Check Refinancing Costs- Calculate all the costs associated with switching, including application fees, legal/settlement fees, and potential Lenders Mortgage Insurance (LMI) if your LVR will be above 80%.

Step 4: Apply and Get Approval- Submit your formal application to the new lender with all necessary documentation. Once approved, the new lender will arrange for the property valuation and send you the new loan offer for acceptance.

Step 5: Settlement and Switching- The new lender settles the loan, pays out your old mortgage, and registers the new mortgage on your property title. Your new repayments then begin with the new lender.

Costs of Refinancing a Home Loan

While a refinance aims to save money, it’s crucial to account for the upfront costs. Refinancing a home loan in Australia typically costs between $500 and $2,000, but it can be higher depending on your situation.

| Cost/Fee | Description | Estimated Cost (Australia) |

| Fixed Loan Break Fee | A significant fee charged by your current lender for ending a fixed-rate loan early. | Can be thousands (highly variable) |

| Discharge Fee | Charged by your current lender for closing the loan and releasing the mortgage. | Typically $200 – $400 |

| Application/Establishment Fee | Charged by the new lender to set up the new loan. Often waived or covered by a cashback offer. | Usually $0 – $750 |

| Valuation Fee | Charged by the new lender to assess the property’s value. Often waived. | $0 – $600 |

| Mortgage Registration Fee | Government fee to register the new mortgage with the relevant state/territory land office. | Varies by state (approx. $130 – $250) |

| Lenders Mortgage Insurance (LMI) | A one-off premium if you are refinancing with an LVR greater than 80%. | Thousands of dollars |

Breakeven Point: You must calculate your breakeven point—how long it will take for your monthly savings to recoup the total switching costs.

Example: If your switching costs are $2,000 and you save $189 per month by refinancing, your breakeven point is roughly 10.6 months ($2,000/$189). If you plan to keep the loan for longer than 11 months, the refinance is worth it.

Should You Refinance in 2025?

Based on the latest RBA information, 2025 has been a year of easing monetary policy, with several interest rate cuts already enacted.

RBA Outlook for 2025 (as of late 2025):

- The Reserve Bank of Australia (RBA) has cut the official cash rate several times in 2025, bringing it to a recent level of 3.60% (as of September 2025).

- The RBA notes that inflation is within its 2−3% target range.

- The general outlook from major banks is for interest rates to remain steady or drift lower into early 2026. For example, some forecasters are predicting the cash rate to be around 3.35% by early to mid-2026.

- This environment of falling interest rates often spurs competition among lenders, leading to better deals and potential cashback offers for new customers.

Guidance: Given the trend of lower rates and the competitive market, 2025 is potentially a very good time to refinance your home loan if you are on a variable rate or if your fixed rate is expiring. However, the decision depends on your personal financial situation, your goals (e.g., shorter term vs. lower repayments), and your risk appetite. Consult a broker to assess the specific offers available to you.

How Capkon Melbourne Helps with Home Loan Refinancing

As your dedicated mortgage broker in Melbourne, Capkon Melbourne simplifies the complex process of refinancing your home loan.

- Personalised Advice: We provide tailored guidance on whether refinancing is right for you and if the potential savings outweigh the switching costs.

- Access to Multiple Lenders: We don’t just compare the big banks; we have access to a wide panel of lenders and competitive products, ensuring you get the best deal.

- End-to-End Support: We handle the application process, paperwork, liaise with both your old and new lender, and manage the settlement to save you time and stress.

- Ongoing Review: We offer ongoing support to ensure your loan remains competitive even after settlement, helping you review your loan every 1-2 years.

FAQ related to When and When Not to Refinance Your Home Loan

Q1: When should you refinance your home loan?

A: You should consider refinancing when you can secure a significantly lower interest rate, gain access to beneficial loan features (like an offset account), or when your fixed-rate term is about to expire and revert to a higher standard rate.

Q2: What are the risks of refinancing?

A: The primary risks are that the switching costs (break fees, discharge fees, application fees) outweigh your savings, or that the new loan doesn’t offer the features you need. Frequent refinancing can also negatively impact your credit score.

Q3: How often can you refinance your home loan?

A: Technically, you can refinance as often as you like, but it’s generally recommended to review your loan annually and only consider refinancing every 2-3 years to ensure the savings compensate for the costs.

Q4: Is refinancing worth it if interest rates are rising?

A: Yes, if you refinance from a variable rate to a fixed-rate home loan when rates are rising. This can lock in your repayments and provide budget certainty, shielding you from further increases.

Q5: What do you need to refinance your home loan?

A: You need proof of identity, stable income documentation (payslips/tax returns), statements for all existing debts, and a good credit history. A new valuation of your property will also be required by the new lender.

Q6: Can I refinance if I have bad credit?

A: It is more challenging, but possible. You may need to use a specialist lender who charges a higher interest rate. If your credit issues have resolved, you may be able to refinance from a specialist lender to a major bank after your credit file clears.

Q7: How does Capkon Melbourne help with refinancing?

A: Capkon Melbourne assesses your current loan, compares hundreds of products, negotiates with lenders on your behalf, calculates your breakeven point, and manages the application and settlement process, all while ensuring the new loan meets your long-term financial goals.

Q8: Is 2025 a Good Time to Refinance Your Home Loan?

A: With the RBA cutting the cash rate multiple times in 2025 and an outlook for stable or slightly lower rates, competition among lenders is high. This makes 2025 a favourable time for many borrowers to secure a lower rate or a better deal.