Call Prakash Acharya

Call Amrit Lamsal

A debt-to-income ratio (DTI) is enough of a mouthful of a financial term that you would use when you take out a mortgage, but it does reveal a remarkably simple truth about your finances. Lenders rely on it to determine the extent to which you can comfortably accept new repayments without straining yourself thin. And as far as you are concerned, knowledge of your DTI may be the difference between being approved and getting a lower rate, or simply knowing that you have to sort a few things out before applying.

Having your DTI is an advantage (assuming you want to purchase a home, refinance your home loan, or even get a personal loan). Let’s break down what it is, how to calculate it, and why this simple debt ratio for home loans matters so much in Australia.

What Is a Debt-To-Income Ratio?

Your debt-to-income ratio is basically a snapshot of how much of your gross monthly income goes toward debt. Lenders love it because it gives them a fast, pretty realistic idea of your financial breathing room.

Debt-To-Income Ratio = Total Debt ÷ Gross Income

Definition:

It’s the percentage you get when you divide your total monthly debt repayments by your gross (before-tax) monthly income.

Why lenders care:

Banks are interested in determining whether you are comfortable handling a new loan in addition to what you already owe. A low DTI indicates that you are not overstretched. A high one makes them nervous, even if you feel fine day-to-day.

Quick example:

Assuming you earn a monthly income of $4,000 and that you owe a debt amounting to $1,000, your DTI is 25%. Pretty healthy.

How to Calculate Your Debt-To-Income Ratio

The good news: calculating your DTI is easier than trying to understand half the jargon on your home loan contract.

Here’s the step-by-step:

- Add up your monthly debt payments.

Think about minimum credit card repayments, personal loans, car loans, student loans, buy-now-pay-later commitments, and the estimated mortgage repayment if you’re applying for a home loan. - Divide that number by your gross monthly income.

That’s your income before tax or super contributions. - Multiply by 100.

That gives you your DTI percentage.

Example:

- Gross Monthly Income: $5,000

- Monthly Debts: $1,500

- DTI = ($1,500 ÷ $5,000) × 100 = 30%

If maths isn’t your thing, an online debt-to-income ratio calculator will do the heavy lifting in seconds.

Ideal Debt-To-Income Ratios for Borrowers

Every bank has its own internal rules, but most Australian lenders tend to follow similar benchmarks:

| DTI Range | Financial Position | Lending Risk |

| Less than 36% | Strong | Low (favoured by lenders) |

| 36%– 43% | Acceptable | Moderate (still workable) |

| Above 43% | Risky | High (likely to be declined) |

For first home buyer loans in Australia, staying under about 40% gives you the best chance of approval and better interest rate options. When rates move, lenders want to know you have enough buffer to keep making repayments without stress.

Why Debt-To-Income Ratio Matters for Home Loans

Your DTI can influence your home loan outcome more than you might expect. Lenders use it as a quick snapshot of your financial health-how much you earn versus how much you owe- and it often becomes a deciding factor long before they look at the finer details of your application.

It affects:

- Your risk profile: A higher DTI signals to lenders that a larger share of your income is tied up in existing commitments, which increases your perceived risk.

- Your interest rate: The lower the DTI of the applicants, the more financially stable they are, and they have a better bargaining power to obtain more competitive rates.

- Your approval chances: Banks can delay the process, demand supporting documents, or even require you to reduce or close some of your debts before they proceed with granting you approval.

A surprisingly large number of borrowers get knocked back simply because they didn’t check this number first. Understanding your DTI early gives you time to improve it-and puts you in a much stronger position when it’s time to apply.

How to Improve Your Debt-To-Income Ratio

If your DTI looks a bit too high, don’t panic; there are practical ways to bring it down.

- Tackle high-interest debt first. Credit card balances and personal loans significantly impact the DTI.

- Avoid taking new loans for a while. Even a small car loan can tip your ratio.

- Increase your income (if possible). A salary bump, side income, or promotion can instantly change your DTI.

- Consider debt consolidation. Combining debts into one loan with a lower interest rate can reduce your total monthly repayments-just make sure the longer term doesn’t cost you more overall.

Even shaving a few hundred dollars off your monthly obligations can make your DTI dramatically more lender-friendly.

Debt-To-Income Ratio vs Other Financial Metrics

Lenders don’t look at DTI alone. It’s just one piece of a broader financial profile they build to understand how safely you can manage a home loan. When they assess your borrowing capacity, they combine several indicators to get a more accurate picture of your long-term financial behaviour- not just your monthly numbers.

Here’s what else they consider:

Loan-to-Value Ratio (LVR):

This compares the amount you want to borrow with the property’s market value. A high LVR (meaning you’re borrowing most of the property price) signals higher risk because you have less equity. Borrowers with lower LVRs are typically rewarded with better interest rates and fewer lending conditions.

Credit Score:

Your credit score reflects how reliably you’ve managed debt in the past-credit cards, personal loans, buy-now-pay-later accounts, and more. A strong credit score can soften concerns around a slightly higher DTI, while a poor score may amplify them. Banks want to see evidence of consistent repayments and responsible lending behaviour.

Savings Behaviour:

While not a formal metric, your saving habits matter. Lenders check whether you have a history of genuine savings, because it suggests discipline and financial stability. Regular contributions to a savings account-even small ones-can boost your overall profile and balance out other weaknesses.

Loan-to-Income Ratio (LTI):

- Australia also uses LTI, particularly for larger loan amounts or high-income applicants.

- DTI shows short-term affordability- how easily you can manage repayments month to month.

- LTI looks at the size of your total debt compared to your annual income indicator of how stretched you might become over time.

Together, these metrics help lenders assess both your immediate repayment capacity and your long-term financial resilience. A strong overall profile can compensate for a slightly higher DTI, but a weak combination can limit how much a bank is willing to lend-even if your DTI looks acceptable on paper.

Common Questions About Debt-To-Income Ratio

Q1: What is a good debt-to-income ratio for getting a home loan?

A good DTI depends on how the lender measures it. In Australia, most lenders look at both your monthly DTI and your total debt vs annual income:

Monthly DTI:

- Below 36% = strong

- 36%–43% = acceptable

- Above 43% = high risk

DTI based on annual income (commonly used by Australian lenders):

- 3–5 = good

- 6+ = considered risky

- 7–8+ = may trigger stricter checks or declines

Overall, a lower DTI improves your approval chances and helps you secure better loan terms, but lenders still consider other factors like LVR, income stability, savings history, and credit score.

Q2: Can I apply for a loan if my DTI is high?

You can try, but approval becomes tougher. A large deposit or strong financial history might still get you across the line.

Q3: How does DTI affect interest rates?

Lower DTI usually leads to stronger offers and more competitive rates. Higher DTI often means fewer options.

Q4: Can I use a debt-to-income ratio calculator online?

Yes, banks and comparison websites offer free calculators that are easy to use.

Q5: What’s the difference between DTI and the loan-to-income ratio in Australia?

Debt-to-Income Ratio (DTI) compares your monthly debt repayments to your monthly income. It shows how comfortably you can manage ongoing repayments.

Loan-to-Income Ratio (LTI) compares your total loan amount to your annual income. It shows whether the overall size of the loan is reasonable based on what you earn.

In simple terms:

- DTI = monthly affordability

- LTI = total borrowing size

Australian lenders often use both to assess risk.

Q6: How often should I check my DTI?

Any time you’re planning a major financial decision, especially before applying for a home loan.

Q7: Can consolidating debts help improve DTI?

Yes, if it lowers your total monthly repayment. Just be careful with longer terms that increase the total interest paid.

Contact Capkon today for more detailed info about the debt-to-income ratio. Our team of professional mortgage experts are only one call away for all your queries!

Many Australian doctors are unaware of the exclusive home loan advantages available to them. From waived Lenders Mortgage Insurance (LMI) to discounted interest rates and flexible lending policies, medical professionals enjoy some of the most competitive borrowing conditions in the market.

At Capkon Melbourne, we specialise in helping doctors and healthcare professionals unlock these benefits to save thousands and build stronger financial foundations. Let’s uncover the hidden perks that many doctors overlook when applying for a home loan.

What Makes Doctor Home Loans Different?

Doctors are considered some of the most reliable borrowers in Australia. Lenders view medical professionals as low-risk due to their stable income, strong employment outlook, and long-term career security. As a result, banks often offer exclusive home loans for doctors.

These benefits typically include:

- Higher borrowing capacity

- Special interest rate discounts

- An easier and faster approval process

- Reduced documentation requirements

Doctor-specific home loans are built to recognise the financial stability and future earning potential of medical professionals, making it easier for them to secure competitive lending terms.

Lenders Mortgage Insurance (LMI) Waivers – The Big Hidden Advantage

For most borrowers, purchasing a property with less than a 20% deposit means paying costly Lenders Mortgage Insurance. However, many lenders offer full LMI waivers for doctors-even up to 90–95% Loan-to-Value Ratio (LVR).

This single benefit can save doctors tens of thousands of dollars upfront.

Example:

On a $1 million property with a 90% loan, a typical buyer might pay over $20,000 in LMI. With the right lender, a doctor could avoid this cost entirely.

This is one of the most valuable-but least known-advantages available to medical professionals.

Discounted Interest Rates and Special Loan Packages

Doctors often qualify for exclusive rate discounts and premium loan packages not available to the general public. These may include:

- Lower variable and fixed interest rates

- Annual fee waivers on professional packages

- Discounted or no-fee offset accounts

- Reduced ongoing fees

These privileges acknowledge the financial reliability and long-term earning capacity of medical professionals, helping them save significantly over the life of their loan.

Higher Borrowing Capacity for Medical Professionals

Medical professionals often qualify for higher loan-to-income ratios compared to standard applicants. Lenders understand that doctors’ incomes grow steadily over time, especially after specialist training or establishing a practice.

Example:

A newly qualified GP or dentist may be able to borrow 6–7 times their annual income, while other borrowers may be limited to 5–6 times.

This expanded borrowing power gives doctors more flexibility when purchasing a home or investment property.

Flexible Repayment and Offset Options

Doctor home loans usually come with premium flexibility designed to support professionals through training, career transitions, and demanding schedules. Common features include:

- Multiple offset accounts

- Redraw facilities

- Interest-only repayment options during training or early practice setup

- Options to structure repayments around shift work or irregular income periods

This flexibility allows medical professionals to manage their finances confidently while focusing on their careers.

Business and Practice Finance Options for Doctors

Many lenders also provide specialised finance options for doctors looking to purchase, expand, or set up a medical practice. These can include:

- Practice purchase loans

- Fit-out or equipment finance

- Business expansion loans

- Working capital facilities

Capkon Melbourne helps medical professionals integrate both home and business finance into a single, streamlined strategy-making it easier to plan for long-term growth.

Why Many Doctors Miss Out on These Benefits

Despite all the advantages available, many doctors still end up applying for standard home loans. This usually happens because:

- They apply directly through mainstream banks

- They don’t disclose their medical profession

- They aren’t aware of the niche lending policies created specifically for them

- They assume their existing loan structure is the best they can get

As a result, doctors often miss out on significant savings and loan features designed to support their financial success.

How Capkon Melbourne Helps Doctors Unlock Hidden Home Loan Perks

At Capkon Melbourne, we partner with lenders who specialise in home loans for medical professionals. Our expert mortgage brokers in Melbourne help doctors:

- Identify lenders offering LMI waivers and rate discounts

- Compare professional loan packages

- Secure competitive doctor-specific mortgage deals

- Negotiate flexible terms suited to your unique career path

- Combine home and business finance for a seamless strategy

We ensure you receive every benefit available to you as a medical professional.

Should You Refinance Your Existing Loan as a Doctor?

Even if you already have a home loan, you may still qualify for improved terms through a medical professional mortgage package. Many doctors recommend:

- Access lower interest rates

- Unlock waived or refunded LMI

- Reduce annual fees

- Add offset or redraw features

- Consolidate business and personal finance

Capkon Melbourne conducts a full loan health check to determine how much you could save by switching.

Speak to Capkon Melbourne- Specialists in Doctor Home Loans

If you’re a doctor, dentist, or healthcare professional in Melbourne, you could be eligible for exclusive home loan benefits that most borrowers never receive.

Capkon’s mortgage experts can guide you through every available offer and help you secure a smarter, more cost-effective home loan.

Book a consultation with Capkon Melbourne today to discover how much you can save on your next home loan.

FAQ

Q1: What is a doctor’s home loan, and how is it different?

A doctor’s home loan is a specialised mortgage product offering benefits such as LMI waivers, higher borrowing limits, and discounted rates-exclusive to medical professionals.

Q2: Do all doctors qualify for LMI waivers?

Most medical practitioners, including GPs, specialists, dentists, anaesthetists, and surgeons, qualify. Eligibility varies by lender.

Q3: Can medical students or interns access doctor loan benefits?

Some lenders offer certain benefits to final-year medical students, interns, and registrars, depending on income and employment contracts.

Q4: Which lenders offer special home loans for doctors in Melbourne?

Several major banks and select non-bank lenders offer these packages. Capkon Melbourne matches you with the most suitable option.

Q5: Can I use a doctor loan to buy an investment property?

Yes. Many lenders offer doctor-specific benefits for both owner-occupied and investment loans.

Q6: How much can doctors borrow compared to standard applicants?

Medical professionals can often borrow 6–7x their income, depending on the lender, compared to 5–6x for most borrowers.

Q7: Does Capkon Melbourne help doctors with refinancing and business loans?

Absolutely. We assist with home loans, refinances, practice finance, and business lending for medical professionals.

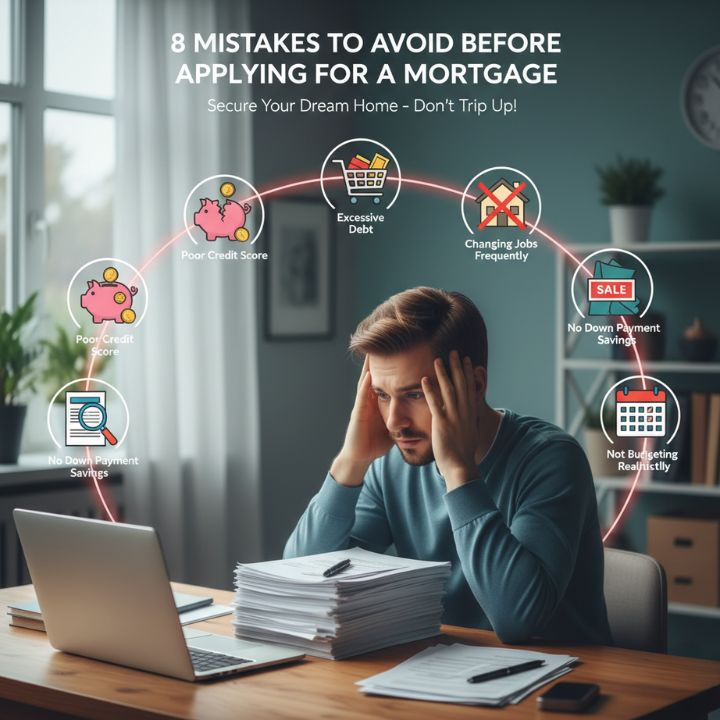

A mortgage application is a large financial commitment that you will encounter. It is not only about having a house in your pocket- it is about establishing long-term financial stability.

Although acquiring the right home loan will save you thousands in the long run, a little slip in the process may cause delay, refusal, or unwarranted expenses. Whether it is a first-time buyer home loan or refinancing, it is better to know what not to do, which can be the difference.

This guide discusses the most common pitfalls one should avoid before applying for a mortgage and how to prevent them.

Common Mortgage Mistakes to Avoid

It is important to know the pitfalls that may undermine your application or add to its cost before nailing down a home loan. Most of them are mere negligence that might lead to long-term effects in case they are not detected early.

Applying Without Checking Your Credit Score

Your credit score is a key part of every mortgage application. It shows lenders how well you manage your financial obligations. Scheduling an appointment without looking at it is a way to be caught off guard – by old defaults, delayed payments, or false listings that may negatively affect your application.

What to do: Get a free copy of your credit report from major Australian credit reporting agencies like Equifax or Experian. Before applying, ensure you are paying down the debts where appropriate, check on mistakes, and ensure that the scores of your financial behaviour are accurately reflected.

Taking on New Debt Before Applying

Avoid opening new credit cards, taking out car loans, or using buy-now-pay-later services before applying for a mortgage. These debts reduce your borrowing capacity and may make lenders view you as a higher risk.

Lenders assess your total financial commitments, so even if you can afford repayments now, new obligations can affect how much you’re allowed to borrow.

Ignoring Hidden Fees

A low interest rate might look attractive, but fees can quickly erode potential savings. Application fees, monthly account fees, and Lenders Mortgage Insurance (LMI) are just a few examples of costs that many borrowers overlook.

Tip: Always ask for a loan’s comparison rate, which includes interest and standard fees, giving you a clearer view of the true cost.

Failing to Compare Lenders and Loan Products

Many borrowers simply go to their main bank, assuming it’s the best option. In reality, different lenders offer a range of rates, policies, and features. Some are better suited to first-home buyers; others cater to investors or self-employed applicants.

Comparing multiple lenders and loan types ensures you’re not missing out on a deal that fits your situation better. Even a 0.25% difference in interest rate can save thousands over the life of a mortgage.

Overestimating Your Borrowing Capacity

Simply because you are entitled to a given amount does not imply that you should take it. The debt to the hilt may have you susceptible to financial strain in case interest rates go up or your financial condition alters.

Calculate the amount of the repayment that fits in your monthly finances and leaves you with space to handle other expenses and future aspirations.

Overlooking Your Long-Term Financial Goals

A lot of buyers are preoccupied with getting approved and never meditate on how the mortgage will fit into their larger financial picture.

Mortgage is not a matter of having a house but a way of living and a decades-long establishing financial stability.

Assess Future Income and Career Changes

Consider the way your income will change. Do you plan a study break, parental leave or a change of career? Will your income level rise or fall drastically? Select a loan model that will allow flexibility in such possibilities.

Plan for Life Events

Major milestones like marriage, children, or starting a business can all affect your ability to make repayments. Planning for these events ensures you won’t have to make rushed financial decisions later.

Think About Exit Strategies

Consider how easy it is to refinance, sell, or pay off your loan early. Some fixed-rate loans come with break fees if you exit early, while others offer flexible features that make refinancing smoother.

Avoid Overextending

When a lender provides more than you are anticipating, it may be tempting to accept it. However, it may be something that your future self will regret. Borrow an amount that you can comfortably repay to have room to save, have an emergency fund and adjust your lifestyle accordingly.

Example: A couple that takes a loan to the fullest value without considering future childcare costs might easily experience severe financial stress in a few years.

Failing to Review Your Employment and Income Documentation

One of the main reasons mortgage applications get delayed or rejected is incomplete or inconsistent documentation. Australian lenders are strict about verifying income to ensure borrowers can handle repayments.

Gather the Right Documents

Before you apply, collect the following:

- Recent payslips showing your income and employer details

- At least two years of tax returns and assessment notices

- Employment letters verifying your role and income

- Bank statements showing regular salary deposits

For self-employed applicants, add:

- Business financial statements for the last two years

- BAS statements

- A letter from your accountant verifying your income

Check for Consistency

Make sure all figures across documents, including payslips, tax returns, and your application, line up. Even small discrepancies can lead to delays as lenders ask for clarification.

Example: A buyer with a casual contract, assuming it counts as full-time income, may have their application rejected because the lender can’t verify consistent earnings.

Not Understanding Your Loan Options

There are many types of home loans, and each one affects how you manage repayments and interest over time. Choosing the wrong structure can be an expensive mistake.

Fixed, Variable, or Split Loans

- Fixed-rate loans lock in your interest rate for a period (usually 1–5 years), offering repayment certainty. However, they often come with restrictions on extra repayments and refinancing.

- Variable-rate loans move with market interest rates, meaning your repayments can go up or down. They’re usually more flexible but come with uncertainty.

- Split-rate loans combine both a fixed part variable offering a balance of stability and flexibility.

Loan Features Matter

Offset accounts, redraw facilities, and the ability to make extra repayments can save you years off your loan term and reduce interest paid.

Choosing the Right Option

Consider how long you plan to stay in your property, your comfort with rate changes, and your long-term goals before deciding.

Skipping Pre-Approval

Pre-approval gives you a clear picture of how much you can borrow before you start house hunting. It’s not a full loan approval, but it’s a strong indication from a lender that you’re eligible within certain limits.

Benefits of Pre-Approval

- Helps you set a realistic budget

- Strengthens your negotiating power with agents and sellers

- Speeds up the formal approval process once you’ve found a property

Risks of Skipping It

Without pre-approval, you risk falling in love with a home you can’t afford or missing out on one because your finances aren’t ready.

Example: A buyer who skips pre-approval might make an offer on a property only to discover later that the lender won’t approve the full loan amount.

Not Budgeting for Additional Costs

Buying a home involves far more than just the deposit. Many applicants underestimate the full cost of purchasing and maintaining a property.

Upfront Costs

- Deposit (typically 5–20% of the purchase price)

- Stamp duty (varies by state)

- Loan application and valuation fees

- Legal and conveyancing costs

- Building and pest inspections

Ongoing Costs

- Home and contents insurance

- Council rates and water charges

- Strata fees (if applicable)

- Repairs and maintenance

Failing to budget for these can leave you short of cash when you need it most- or worse, unable to complete your purchase.

Ignoring Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) measures how much of your income is already committed to paying off existing debts. It’s a major factor lenders use to assess your ability to handle a mortgage.

A high DTI can reduce your borrowing capacity or result in a declined application.

How to Improve It

- Pay off or reduce credit card balances

- Consolidate personal loans where possible

- Avoid taking on any new debt before applying

- Lower your credit limits to reduce your perceived risk

Monitoring and improving your DTI before you apply makes your application stronger and shows lenders you’re financially disciplined.

Relying Only on Interest Rates

A low interest rate might look appealing, but it doesn’t always mean the cheapest loan. Some low-rate products come with high ongoing fees, limited flexibility, or expensive penalties for early repayments.

What Else to Consider

- Comparison rates (which include most standard fees)

- Flexibility for extra repayments

- Access to redraw or offset accounts

- Break fees on fixed-rate loans

Example: A loan with a slightly higher rate but an offset account can save more interest over time than a low-rate loan with no flexible features.

Not Seeking Professional Advice

Navigating the mortgage process can be complex and mistakes can be expensive. Working with a qualified mortgage broker or financial adviser can help you understand your options and avoid pitfalls.

Why Expert Advice Helps

- Brokers can compare products across multiple lenders

- They understand lending criteria and policy differences

- They can identify which loans suit your goals and situation

- They handle much of the paperwork, saving time and stress

When choosing a broker, ensure they’re accredited, transparent about fees, and have experience with your type of property or buyer profile.

Steps to Avoid Mortgage Mistakes

To set yourself up for success, take these practical steps guaranteed to approve a loan before applying:

- Check your credit report and correct any errors.

- Calculate your debt-to-income ratio and improve it where possible.

- Research lenders and loan types to find one that fits your goals.

- Budget carefully for both upfront and ongoing costs.

- Get expert advice before submitting your application.

Taking the time to prepare can mean faster approval, lower stress, and a home loan that works for your future.

Ready to Avoid Mortgage Mistakes? Speak With an Expert Today!

Purchasing a house is fun, yet it is a big financial move. By eliminating these pitfalls, you will go into the process of applying for a mortgage with clarity and confidence.

Unless you really know what you want, a qualified mortgage broker or best financial advisor in Melbourne can help you compare and contrast options, prepare your paperwork and walk you through the entire process.

Contact CapKon and have a detailed consultation with our experts today! Better now than never to avoid any mistakes before applying for your mortgage.

FAQs

Q1: What are the biggest mistakes first-time homebuyers make?

Overborrowing, skipping pre-approval, ignoring extra costs, and failing to compare lenders are some of the most common errors.

Q2: How can I check if I’m ready for a mortgage?

Review your savings, income stability, and existing debts. If you can comfortably afford repayments plus living costs, you’re likely in a good position.

Q3: Should I get pre-approval before house hunting?

Yes. It clarifies your budget, strengthens your offers, and speeds up final approval when you find the right property.

Q4: How does my credit score affect my mortgage application?

A higher score can mean better rates and smoother approval. Lenders see it as a sign of responsible borrowing.

Q5: What hidden costs should I budget for before applying?

Include stamp duty, legal fees, inspections, and insurance alongside your deposit.

Q6: Can a mortgage broker help me avoid mistakes?

Absolutely. Brokers can identify the right lender, structure your application correctly, and save you time and stress.

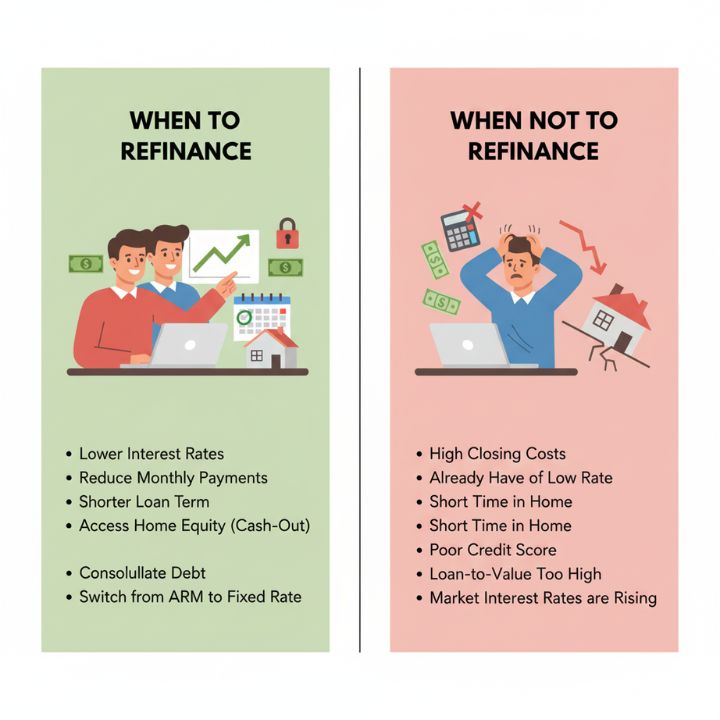

Refinancing your home loan can be a smart financial move, but it isn’t always the right choice. From lowering your interest rate to accessing equity, there are times when refinancing your home loan can save you thousands. However, in other cases, costs and risks may outweigh the benefits.

At Capkon Melbourne, we help borrowers decide when to refinance their home loans and when to hold back. Let’s explore the key situations that determine the right timing and strategy for a home loan refinance.

What Does It Mean to Refinance Your Home Loan?

Refinancing your home loan means you replace your existing mortgage with a new one that has different terms. This can be done with your current lender (an “internal refinance”) or, more commonly, by switching to a different lender entirely (an “external refinance”).

The goal is to secure more favourable terms to improve your financial position.

Common Reasons for a Home Loan Refinance:

- Lower Interest Rate: To reduce monthly repayments and total interest paid.

- Better Loan Features: To gain access to features like an offset account or a redraw facility.

- Consolidating Debts: To roll high-interest personal loans or credit card debt into your mortgage’s lower interest rate.

- Accessing Equity: To borrow extra funds for major expenses like renovations or investment property deposits.

Example: If you have a $500,000 loan at 6.50% and refinance to a new loan at 5.70%, you could save hundreds on your monthly repayments and tens of thousands of dollars in interest over the life of the loan. This is an example of how to refinance your home loan to secure better terms.

When Should You Refinance Your Home Loan?

Knowing when is the best time to refinance your home loan can make a significant difference to your finances. Here are key situations where a home loan refinance makes sense:

- Interest Rates Have Dropped: If market rates for new loans are significantly lower than your current rate.

- Your Introductory Rate is Ending: If you’re on a fixed rate or an introductory variable rate that is about to revert to a higher standard variable rate.

- Your Credit Score Has Improved: A better credit history can qualify you for the most competitive rates and products.

- You Need Flexible Features: If your current loan lacks features like an offset account (which can reduce interest) or a flexible redraw facility.

- You’re Consolidating High-Interest Debts: Using your home loan’s lower interest rate to pay off personal loans or credit cards.

- You’re Accessing Equity: You’ve built up substantial equity and want to cash out for purposes like home renovations or depositing in an investment property.

Example: Switching from a 6.00% rate to a 5.50% rate on a $400,000 loan could save you over $100 per month. Over 25 years, this seemingly small saving totals over $30,000 in interest, demonstrating when you should refinance your home loan.

Refinancing vs. Staying With Your Current Lender

When considering a refinance of your home loan, you have two main options: switch lenders or negotiate with your existing one.

Benefits of Refinancing (Switching Lenders):

- Access to the lowest market rates and most attractive features from competing lenders.

- Opportunity to consolidate debts and access equity.

- Potential for cashback incentives offered by the new lender.

Advantages of Staying Put (Internal Refinance/Negotiation):

- Loyalty Discounts: Your current lender may offer you a discounted rate to keep your business.

- Avoiding Fees: An internal refinance often avoids many of the switching fees (like discharge fees) associated with moving to a new lender.

- Stability: A simpler, faster process with less paperwork and no new credit enquiry.

Who Benefits Most?

- Refinancing: Long-term borrowers with large balances, or those whose current lender refuses to offer a competitive rate or the required features.

- Staying: Borrowers close to the end of their term, those who value simplicity, or those who can negotiate a sharp discount from their existing bank.

Capkon’s Approach: We assess both options by helping you negotiate with your current bank while also comparing the best deals on the market. Our goal is to ensure you don’t switch unnecessarily, but only when the financial benefits are clear.

When Not to Refinance Your Home Loan

A home loan refinance is a good idea when the savings outweigh the costs. Here are situations when you should not refinance your home loan:

- Near the End of Your Loan Term: If you only have a few years left, the cost of switching is unlikely to be offset by interest savings.

- Break Fees Outweigh Savings: If you are on a fixed-rate loan, the break costs can be extremely high, making a refinance financially unviable.

- Selling Your Property Soon: If you plan to sell within a year or two, you won’t have enough time to reach your breakeven point (the point at which your savings equal the switching costs).

- Worsened Financial Situation: If your income is unstable or you’ve taken on significant new debt, a new lender may reject your application or only offer a higher, non-competitive rate.

Warning: Refinancing isn’t always the cheapest option long-term if you repeatedly lengthen your loan term to lower repayments. This increases the total interest paid over the loan’s life.

What Do You Need to Refinance Your Home Loan?

Before applying, prepare the necessary documentation to ensure a smooth process. Knowing what you need to refinance your home loan is the first step in how to refinance your home loan in Australia.

Key Requirements:

- Stable Income and Employment: Payslips (usually the last 2-3 months), Group Certificate/PAYG Summary, or tax returns for self-employed individuals.

- Good Credit History: Lenders will assess your credit file. Too many recent credit enquiries or defaults can negatively impact your application.

- Proof of Property Value (Valuation): The new lender will conduct a valuation to determine your Loan-to-Value Ratio (LVR).

- Loan Documentation: Statements for your current home loan and any debts you plan to consolidate.

- Identification: Driver’s licence, passport, etc.

- Living Expenses: Documentation or a detailed breakdown of your monthly expenses.

The lender assessment involves a thorough review of your financial situation to ensure the new loan is affordable, as required by law.

Steps on How to Refinance Your Home Loan in Australia

The process of a home loan refinance generally follows these five steps:

Step 1: Review Your Current Loan- Examine your existing loan’s interest rate, annual fees, loan features, and any potential exit or discharge fees. Determine your primary goal (e.g., lower rate, new features, or equity access).

Step 2: Compare Lenders and Products- Shop around or work with a mortgage broker like Capkon Melbourne to compare the interest rates and features of loans from different institutions. Focus on the comparison rate, not just the advertised rate.

Step 3: Check Refinancing Costs- Calculate all the costs associated with switching, including application fees, legal/settlement fees, and potential Lenders Mortgage Insurance (LMI) if your LVR will be above 80%.

Step 4: Apply and Get Approval- Submit your formal application to the new lender with all necessary documentation. Once approved, the new lender will arrange for the property valuation and send you the new loan offer for acceptance.

Step 5: Settlement and Switching- The new lender settles the loan, pays out your old mortgage, and registers the new mortgage on your property title. Your new repayments then begin with the new lender.

Costs of Refinancing a Home Loan

While a refinance aims to save money, it’s crucial to account for the upfront costs. Refinancing a home loan in Australia typically costs between $500 and $2,000, but it can be higher depending on your situation.

| Cost/Fee | Description | Estimated Cost (Australia) |

| Fixed Loan Break Fee | A significant fee charged by your current lender for ending a fixed-rate loan early. | Can be thousands (highly variable) |

| Discharge Fee | Charged by your current lender for closing the loan and releasing the mortgage. | Typically $200 – $400 |

| Application/Establishment Fee | Charged by the new lender to set up the new loan. Often waived or covered by a cashback offer. | Usually $0 – $750 |

| Valuation Fee | Charged by the new lender to assess the property’s value. Often waived. | $0 – $600 |

| Mortgage Registration Fee | Government fee to register the new mortgage with the relevant state/territory land office. | Varies by state (approx. $130 – $250) |

| Lenders Mortgage Insurance (LMI) | A one-off premium if you are refinancing with an LVR greater than 80%. | Thousands of dollars |

Breakeven Point: You must calculate your breakeven point—how long it will take for your monthly savings to recoup the total switching costs.

Example: If your switching costs are $2,000 and you save $189 per month by refinancing, your breakeven point is roughly 10.6 months ($2,000/$189). If you plan to keep the loan for longer than 11 months, the refinance is worth it.

Should You Refinance in 2025?

Based on the latest RBA information, 2025 has been a year of easing monetary policy, with several interest rate cuts already enacted.

RBA Outlook for 2025 (as of late 2025):

- The Reserve Bank of Australia (RBA) has cut the official cash rate several times in 2025, bringing it to a recent level of 3.60% (as of September 2025).

- The RBA notes that inflation is within its 2−3% target range.

- The general outlook from major banks is for interest rates to remain steady or drift lower into early 2026. For example, some forecasters are predicting the cash rate to be around 3.35% by early to mid-2026.

- This environment of falling interest rates often spurs competition among lenders, leading to better deals and potential cashback offers for new customers.

Guidance: Given the trend of lower rates and the competitive market, 2025 is potentially a very good time to refinance your home loan if you are on a variable rate or if your fixed rate is expiring. However, the decision depends on your personal financial situation, your goals (e.g., shorter term vs. lower repayments), and your risk appetite. Consult a broker to assess the specific offers available to you.

How Capkon Melbourne Helps with Home Loan Refinancing

As your dedicated mortgage broker in Melbourne, Capkon Melbourne simplifies the complex process of refinancing your home loan.

- Personalised Advice: We provide tailored guidance on whether refinancing is right for you and if the potential savings outweigh the switching costs.

- Access to Multiple Lenders: We don’t just compare the big banks; we have access to a wide panel of lenders and competitive products, ensuring you get the best deal.

- End-to-End Support: We handle the application process, paperwork, liaise with both your old and new lender, and manage the settlement to save you time and stress.

- Ongoing Review: We offer ongoing support to ensure your loan remains competitive even after settlement, helping you review your loan every 1-2 years.

FAQ related to When and When Not to Refinance Your Home Loan

Q1: When should you refinance your home loan?

A: You should consider refinancing when you can secure a significantly lower interest rate, gain access to beneficial loan features (like an offset account), or when your fixed-rate term is about to expire and revert to a higher standard rate.

Q2: What are the risks of refinancing?

A: The primary risks are that the switching costs (break fees, discharge fees, application fees) outweigh your savings, or that the new loan doesn’t offer the features you need. Frequent refinancing can also negatively impact your credit score.

Q3: How often can you refinance your home loan?

A: Technically, you can refinance as often as you like, but it’s generally recommended to review your loan annually and only consider refinancing every 2-3 years to ensure the savings compensate for the costs.

Q4: Is refinancing worth it if interest rates are rising?

A: Yes, if you refinance from a variable rate to a fixed-rate home loan when rates are rising. This can lock in your repayments and provide budget certainty, shielding you from further increases.

Q5: What do you need to refinance your home loan?

A: You need proof of identity, stable income documentation (payslips/tax returns), statements for all existing debts, and a good credit history. A new valuation of your property will also be required by the new lender.

Q6: Can I refinance if I have bad credit?

A: It is more challenging, but possible. You may need to use a specialist lender who charges a higher interest rate. If your credit issues have resolved, you may be able to refinance from a specialist lender to a major bank after your credit file clears.

Q7: How does Capkon Melbourne help with refinancing?

A: Capkon Melbourne assesses your current loan, compares hundreds of products, negotiates with lenders on your behalf, calculates your breakeven point, and manages the application and settlement process, all while ensuring the new loan meets your long-term financial goals.

Q8: Is 2025 a Good Time to Refinance Your Home Loan?

A: With the RBA cutting the cash rate multiple times in 2025 and an outlook for stable or slightly lower rates, competition among lenders is high. This makes 2025 a favourable time for many borrowers to secure a lower rate or a better deal.

Do you need any Assistance in your loan?

We are here to help you.